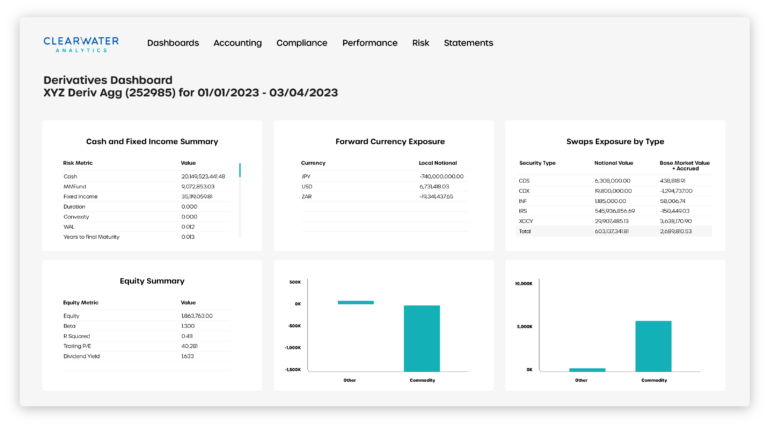

Alternative Investment Platform Solutions

Accounting for Alternatives Has Never Been Easier

Clearwater’s alternative investment platform is designed to simplify processes and make your life easier.

- Alternative asset accounting and reporting with an integrated, multi-asset class platform

- Single pane of glass view for your entire portfolio

- Support for 100+ asset classes spanning public and private markets and derivatives

- Dedicated servicing teams that act as an extension of your organization