The Clearwater Advantage

Simplify the Entire Investment Lifecycle

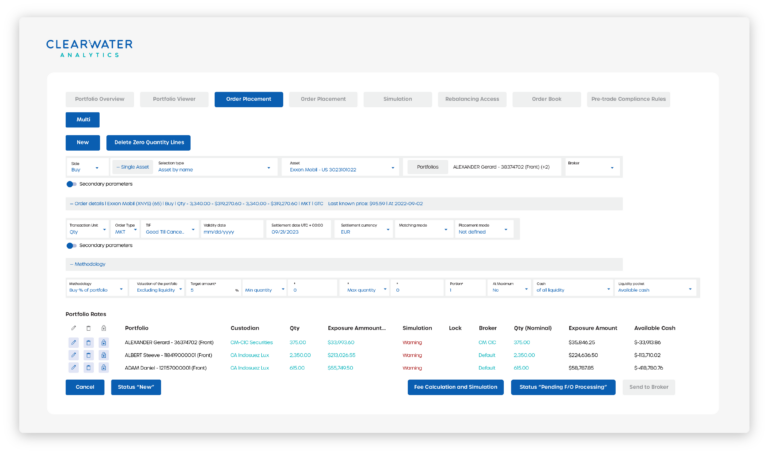

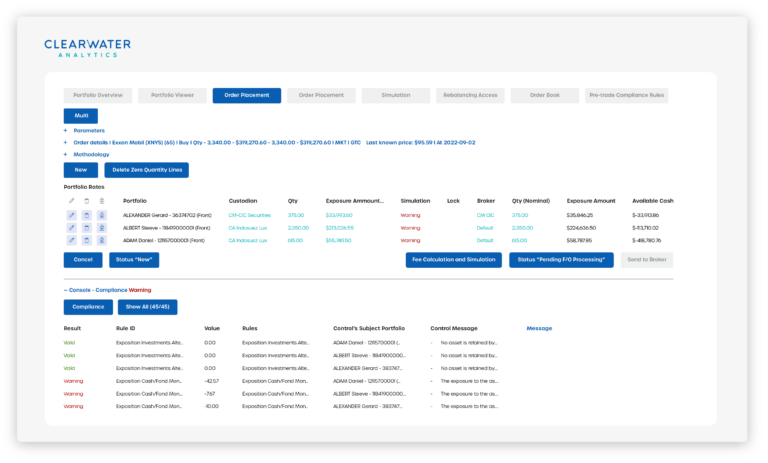

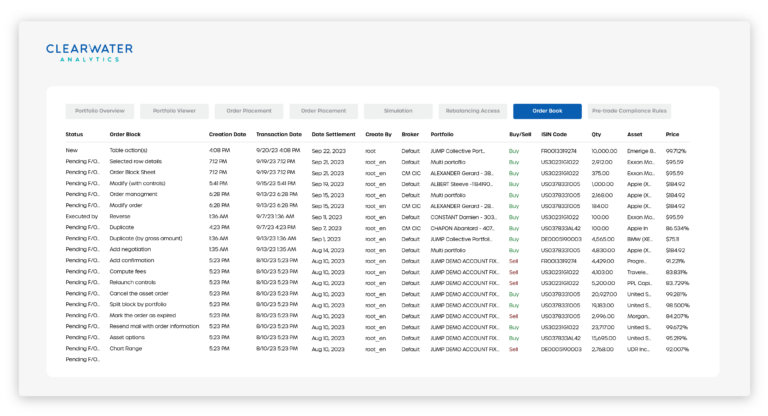

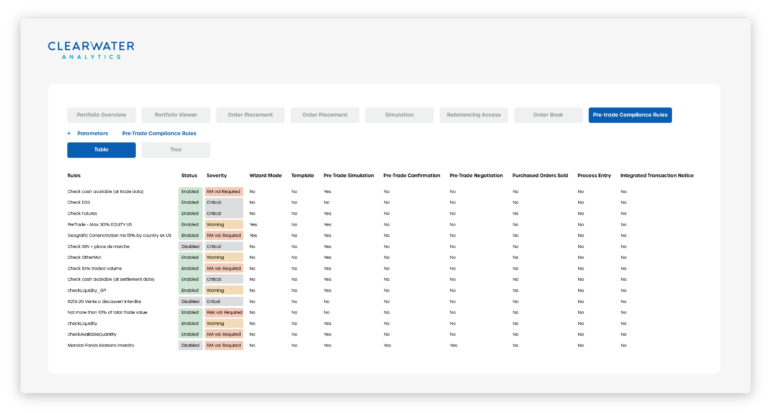

Access the entire lifecycle of your portfolio management chain with a single click. Stage, model, and execute orders all via proven cloud technology that integrates seamlessly with the rest of the Clearwater asset management solution.

- Multi-Asset Trading

- Order Workflow & Management

- Flexibility to manage large and small accounts

- Empower your team with end-to-end automation