Simplify the Full Investment Lifecycle

A full-featured, comprehensive solution, suited to your needs.

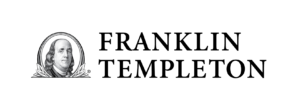

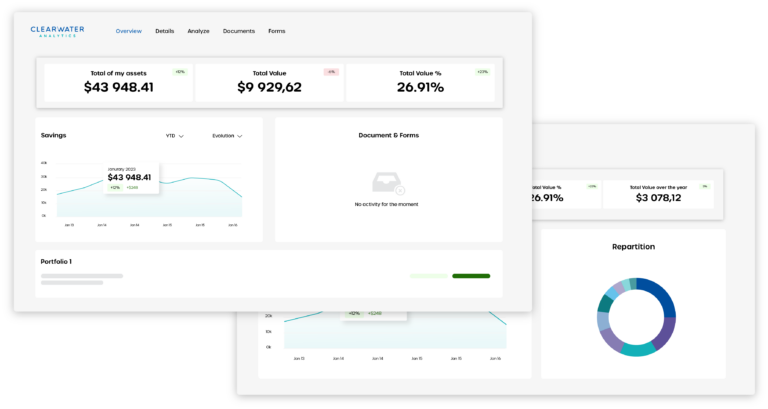

Refine your investment management processes with a single, scalable solution for OMS, PMS, reporting, performance, reconciliation, and data aggregation tools with IBOR functionality.

- Drive strategic decision-making with a system that gives you a real-time view whenever you need it

- Turn insights into action and place orders at the click of a button

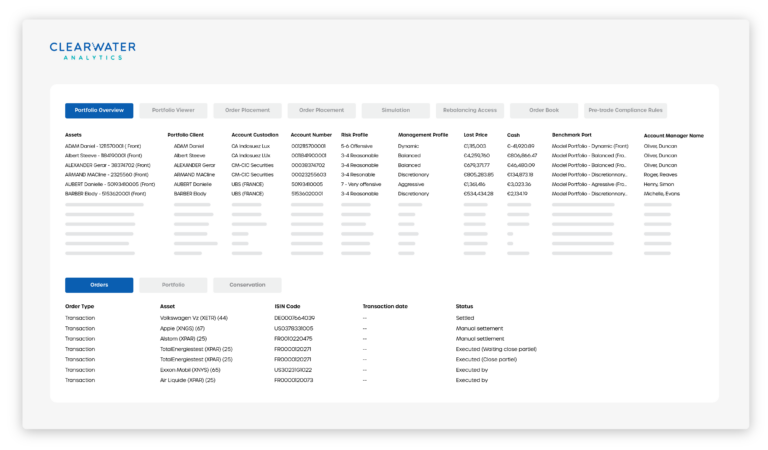

- Create portals custom-fit for your clients and share portfolio details