The Clearwater Advantage

Best-in-Class Performance Book of Record (PBOR)

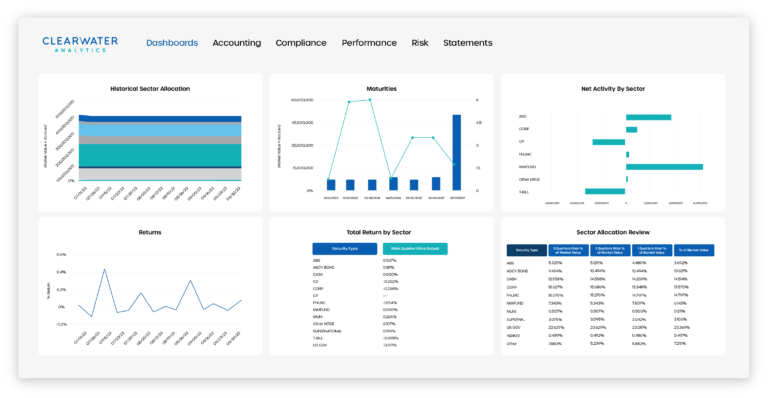

Clearwater’s performance solution provides visibility into returns across asset classes. Supported return types include time-weighted, money-weighted (IRR), and notional returns.

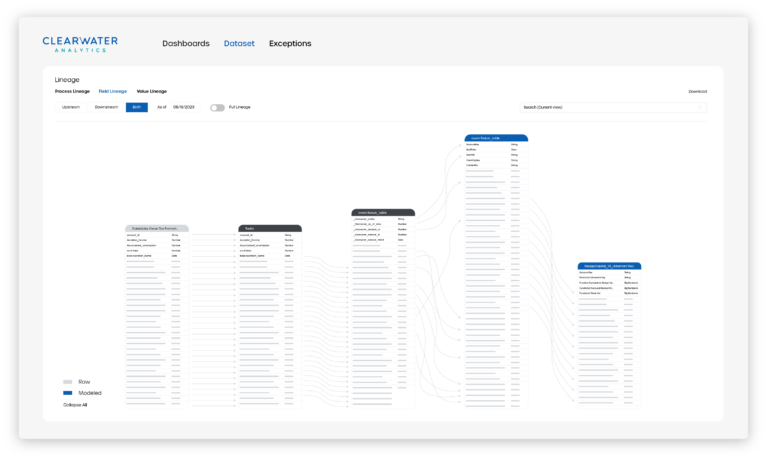

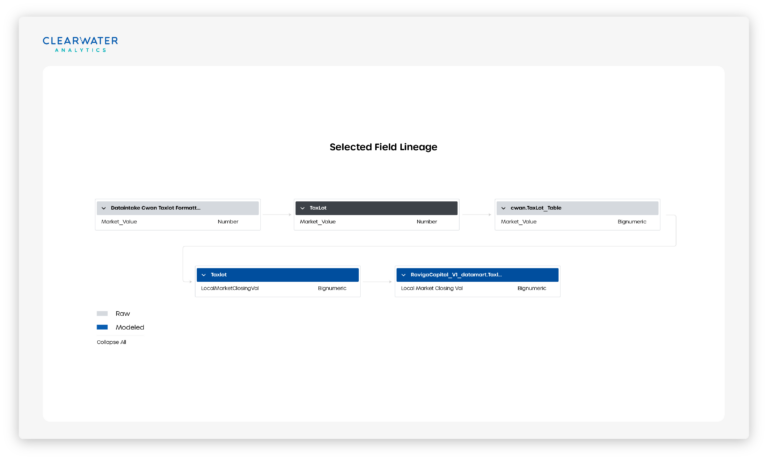

- Support for complex instruments

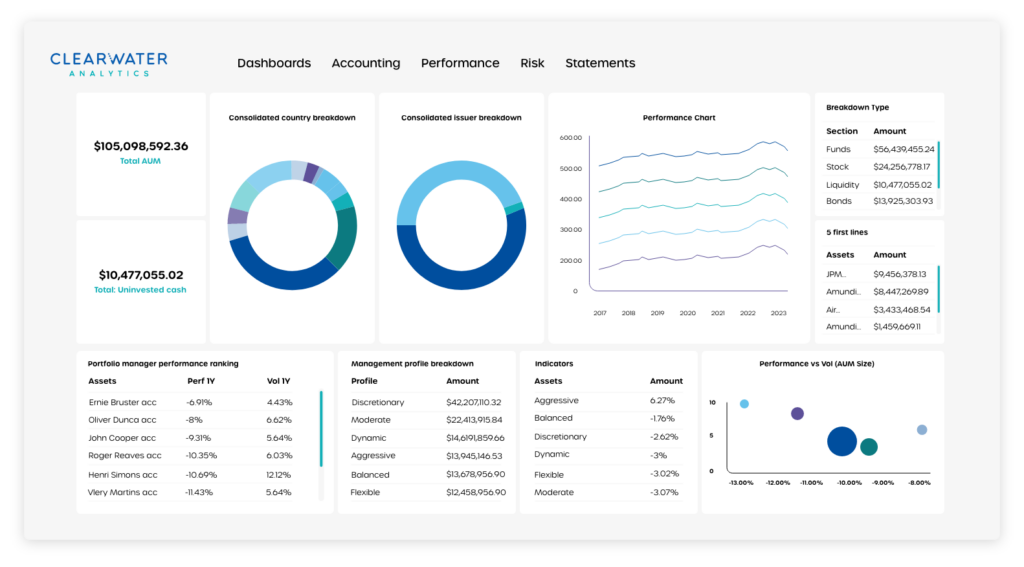

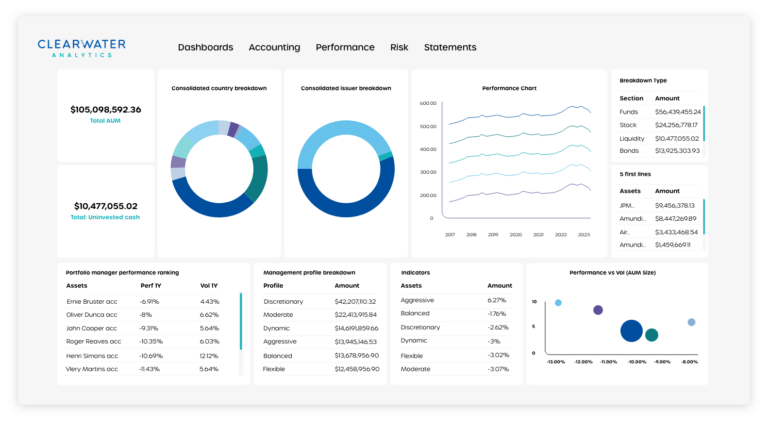

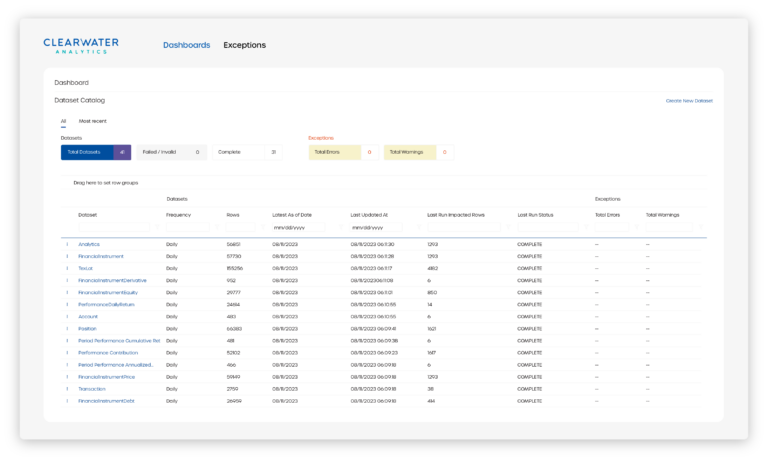

- Easily see data with web-based dashboards

- Measure performance backed by robust calculations