Chris Watts

Insurance Solutions Specialist

Chris is an Insurance Solutions Specialist at Clearwater across Northern Europe. Chris helps insurers identify pain points in their current operating model and how technology can solve such problems and add value to their operations. Prior to joining Clearwater, Chris worked has worked in the insurance industry for over 15 years across a variety of Transformation, Investment and Finance roles.

In 2023, PwC and the Centre for the Study of Financial Innovation (CSFI) released their Insurance Banana Skins Report, scoring the top risks facing today’s Insurance Industry. We are reviewing five of these risks that we see our clients concerned about. This article is the third in the series. Read our other’s here: Regulation, Technology, Climate Change, AI.

Interest rates have once again been ranked as a key risk for insurance executives (8 of 24 risks), albeit at a lower ranking than last year (5 of 24). Whilst there is an optimism that interest rates themselves are peaking, concerns about the macroeconomic environment and the risks posed by weak economic growth with high inflation persist. The risks associated with interest rates for insurers were focused within life insurers (4 of 24) compared to non-life (11 of 24).

This aligns with our discussions with insurance executives where concerns associated with the impacts of a higher interest rate environment are rising, particularly the risk of recession. Many insurers believe this is the greatest risk facing investors over the next few years.

What has happened?

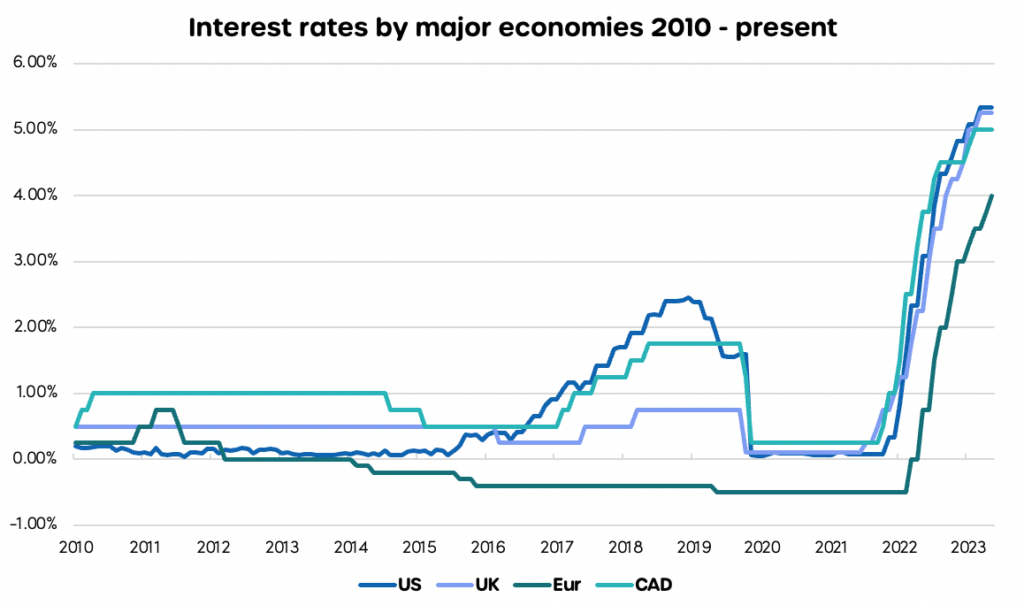

Interest rates globally have materially risen compared to the lows across the 2010s:

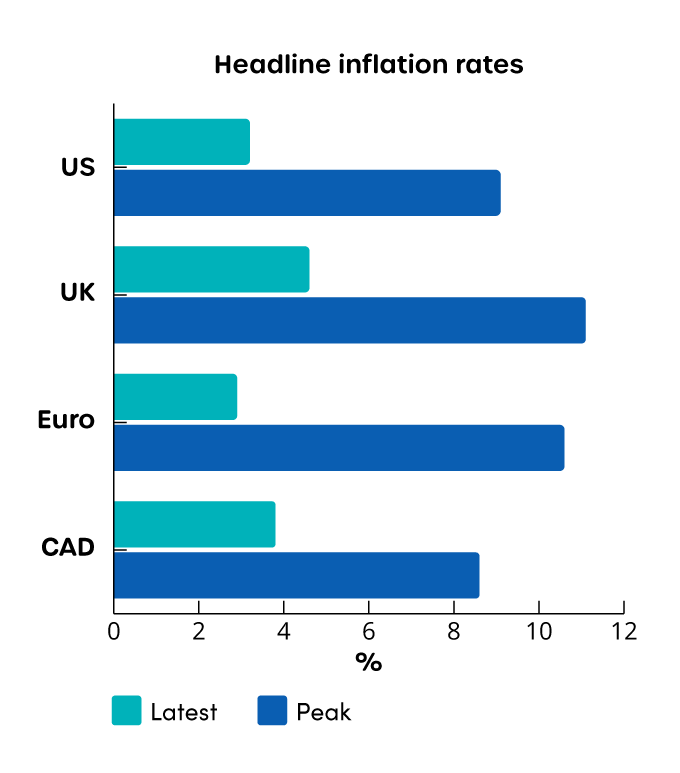

Following a prolonged period of low to normal inflation, supply chain and other pandemic related challenges across 2021/22 resulted in inflation surging across the globe:

The key question for many investors is whether central banks can successfully navigate a multitude of challenges to deliver some form of “soft-landing” during 2024. Some are looking to bond markets, which currently appear appealing with the prospect of future rate cuts – although timing expectations are uncertain. Whilst equity analysts are bullish over the opportunity of double-digit earnings growth in 2024.

3 Key Risks for Insurers

Considering this backdrop and based on our insights, we summarise below the potential key risks for insurers and their investment portfolios:

1 – The broad impact of higher inflation and interest rates

For P&C insurers, many markets continue to see premiums and price rises lag the rate of inflation which is driving the cost of claims upwards month by month. However, the higher interest rate environment should reduce the challenges insurers have faced for the past decade in searching for yield. Expectations are that insurers will be able to rebalance portfolios by utilising opportunities in traditional fixed income asset classes, reducing the reliance on alternative asset classes and improve duration mismatches.

For Life companies, the increase in interest rates results in a material reduction in claim liabilities through the discount rate effect. For most, this has more than offset the reduction in asset valuations. However, prolonged periods of higher inflation have historically resulted in reduced demand for such insurance policies.

The higher interest rate environment is likely to translate into a period of greater volatility. Insurers will need to respond by enhancing real investment returns whilst carefully managing any duration gaps and volatility exposure.

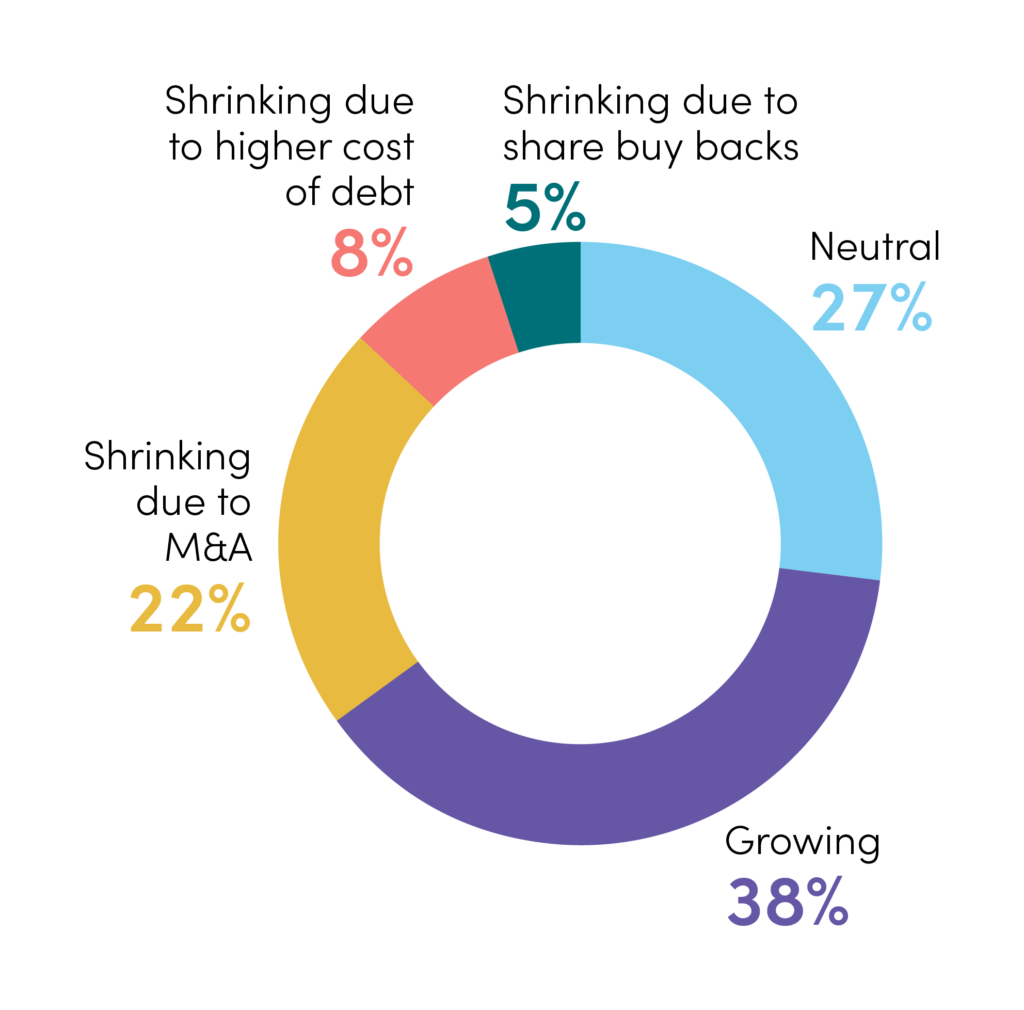

2 – Changes to strategic or tactical asset allocations

Strategic Asset Allocation reviews have been prominent during our conversations with insurers, although to date this has not resulted in a material shift in portfolios. Interest in alternative assets remains high with circa. 40% of insurers planning to increase allocations over the next 12-24 months.

Money market funds have seen a renaissance as higher interest rates quickly flow into the yields available. Our recent client survey found almost 40% were expecting allocations to increase and this aligns with recent analysis from the BlackRock Investment Institute disclosing that global money market fund assets increased towards $8tn in November 2023 – an increase of over 20% in the past 18 months.

3 – Private asset allocations

In the case of private credit, it is common for the underlying agreements to be structured on a floating rate basis meaning that the recent increases in interest rates pass through and allow investors to benefit from higher returns.

However, the additional costs for borrowers can place stress on their balance sheet and negatively impact their ability to service existing debt. Coupled with inflationary pressures, there is a strong likelihood of increased default rates particularly for businesses that were highly levered before the onset of these pressures.

For investors who have already made commitments in the past 3 or 4 years, we expect an increased dispersion of returns across strategies and GPs. Insurers should consider increasing scrutiny of underlying deals and increase their understanding of exposure across sectors.

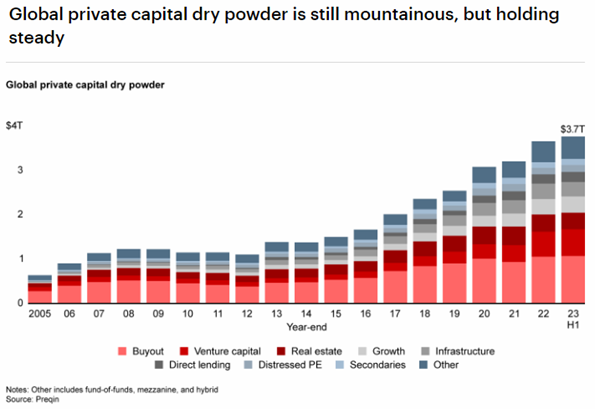

For insurers looking to add allocations to private assets there is an abundance of dry powder built up by asset managers. Despite dry powder reaching $3.7tn in H1 23, insurers continue to believe these assets remain attractive and plan to increase allocations over the next 12-24 months, albeit on a potentially slower path than expected 12-18 months ago.

These balances include a significant overhang from previous vintages which could lead to a reduction in underwriting quality and encourage a race to the bottom for GPs to deploy cash. Therefore, insurers need to continue to act cautiously and focus on understanding the specific risks for each opportunity. Additionally, focusing on teams with experience in restructuring could prove beneficial if the concern about a global recession becomes a reality.

Sometimes risk = returns

Whilst there are clear risks associated with rising and higher interest rates, there are equally plenty of opportunities for insurers looking to diversify their portfolios. Several insurance executives we have met have shared an overview of their asset allocation considerations and for those that are comfortable accepting additional market risk the following opportunities are commonly referenced:

- Consider assets with a link to real returns/inflation:

- Infrastructure assets typically have an explicit link to inflation; often through regulation.

- Real estate again offers a potential hedge to inflation through contractual terms around rentals, however, with occupancy levels being low post pandemic there are clearly potential valuation risks.

- Commodities are also often referenced as an inflation hedge although carry high geo-political risk and volatility in the current climate.

- Consider protecting balance sheets by rebuilding book yields whilst re-assessing key risks such as volatility, duration, and liquidity.

- Private assets could offer a compelling return profile and insurers should be prepared to capitalise on new opportunities but should note there is a need for increased focus on the quality of deals, structure of covenants and any potential favourable regulatory changes such as the treatment under Solvency UK.

Appendix / Resources

Bain analysis chart: https://www.bain.com/insights/stuck-in-place-private-equity-midyear-report-2023/