Automated

Seamless investment data aggregation, validation, and reconciliation.

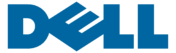

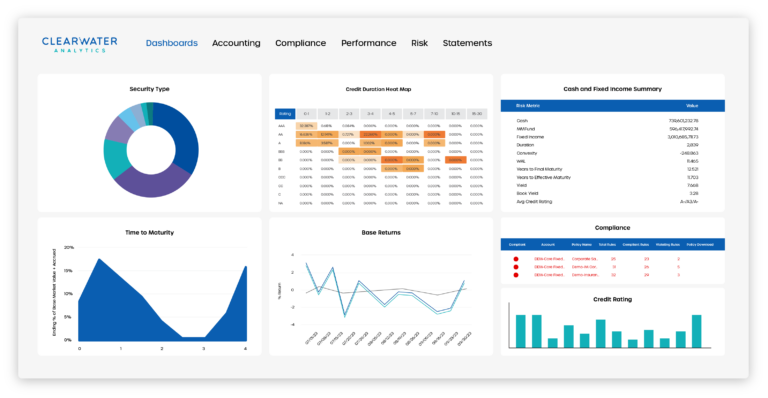

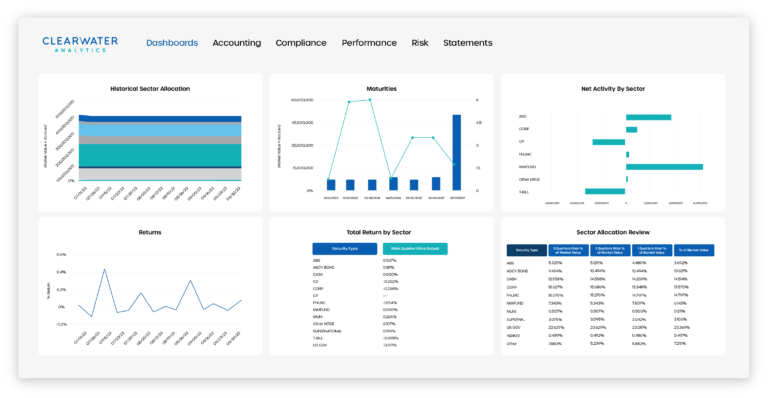

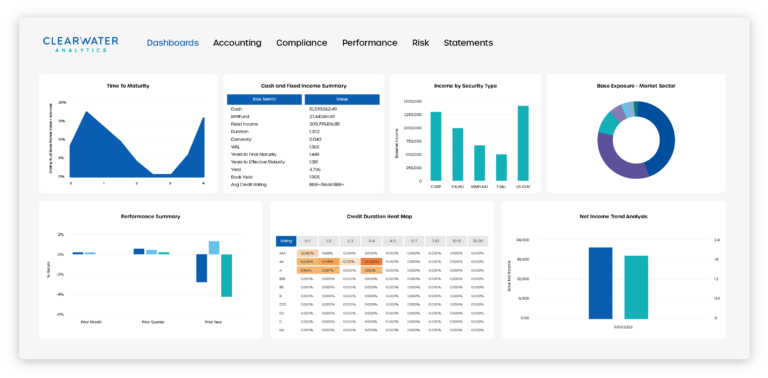

Efficiently scale your investment strategy, diversify asset classes, and improve your data management processes.

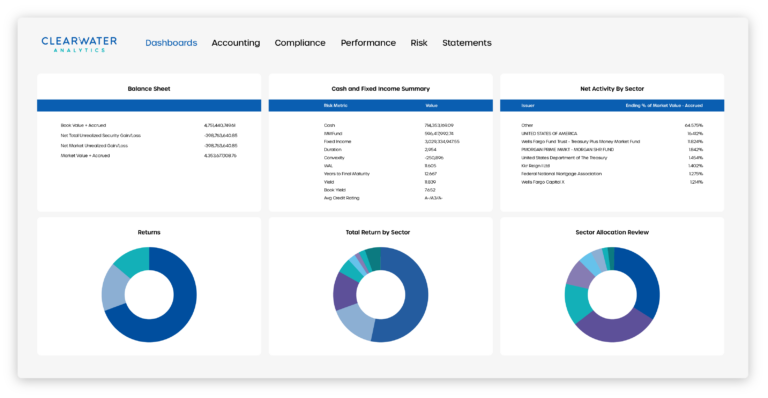

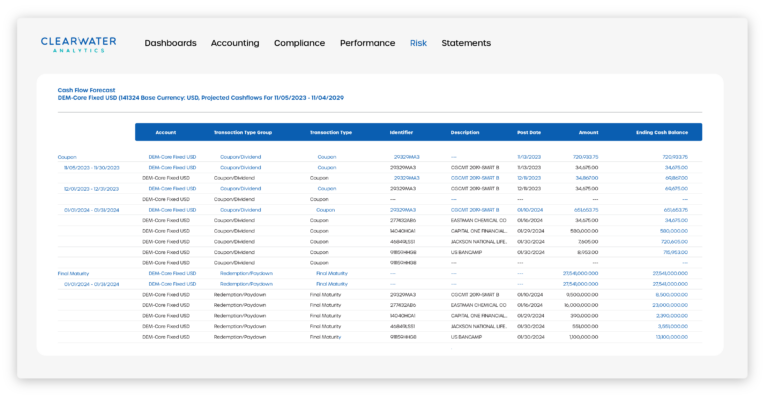

- Integrated with downstream systems to provide clean data to all your investment accounting processes

- Fully validated and reconciled data each day means you can make confident decisions

- Daily audit-quality data enables you to close the books faster