Download a PDF version of Redefining Data Management for Alternative Assets.

Introduction

The growing prominence of alternative assets in investment portfolios marks a transformative shift in asset allocation. According to Fidelity, institutional investors allocate an average 24% of the assets to alternative investments*, driven by their potential to deliver uncorrelated returns and long-term growth. However, managing these assets introduces significant challenges. Unlike traditional assets such as equities and fixed income, alternative investments generate fragmented, unstructured data in high volumes, requiring a fundamentally different approach to both the management of this data and the way in which teams access and interact with it.

Investment firms are finding that traditional systems designed for public markets cannot scale to meet the complexities of alternative assets. Manual processes—though still widely used—are resource-intensive, prone to errors, and unable to keep pace with the demands of modern investment management. As alternative assets become integral to strategic growth, firms must transition to robust, scalable data solutions that ensure high-quality, actionable insights.

Equally critical is the ability to collaborate with data. High-quality data becomes meaningless if it cannot be accessed, analyzed, and integrated across platforms, departments, and external sources in real time. Effective data collaboration enhances operational efficiency, improves decision-making, and ensures firms can meet the growing demands of investors and regulators.

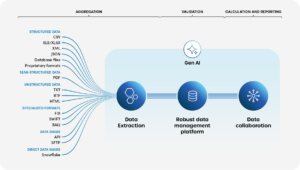

Artificial Intelligence (AI) is the key element in this data evolution. Behind the scenes, it enhances data integration and standardization to create the robust, scalable, and accurate platforms firms need. Then, generative AI tools create opportunities to easily interact with complex datasets through intuitive, conversational prompts. These advancements redefine data management, making it faster, more collaborative, and transformative.

New Assets Demand New Data Solutions

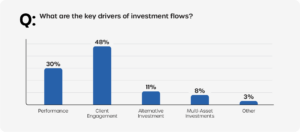

Alternative assets have rapidly emerged as a core component of investment portfolios and new investment flows. As investors increasingly rely on alternative assets for diversification and higher returns, the need for advanced operational processes and resources grows immensely. It is widely acknowledged that the relationship between the increased flows into alternative assets and the operational effort required is not directly correlated—in fact, alternative assets notably increase the operational burden.

*2024 Flash Poll | State of Investment Data Management.” Clearwater Analytics 2024

With global alternative assets under management projected to grow from $15 trillion in 2022 to over $24 trillion by 2028, or $60-$65 trillion by 2033**, the industry’s evolution shows no signs of slowing.

Clearwater data corroborates this trend, showing the significant impact investors’ interest in alternatives is having on investment flows at 11%. Furthermore, when surveyed in 2024 about their alternative investments, 55% of Clearwater clients indicated they plan to increase their allocation to alternative assets over the next five years***.

Managing alternative asset data is complicated however, and presents unique challenges that require a disproportionate allocation of resources:

- Data Complexity: Alternative asset data is fragmented, high-volume, and often unstructured, originating from diverse sources such as private equity firms, real estate platforms, and bespoke financial models. A lack of standardized datasets and bespoke deal structures adds to this difficulty.

- Integration Challenges: Existing data platforms, typically designed for public markets, struggle to scale for the reconciliation, reporting, allocation, and analysis demands of alternative investments.

- Operational Inefficiency: Manual processes are a significant drain on time — creating bottlenecks, increasing the risk of errors, and limiting access to real-time or near-real-time data. Without robust oversight, firms face heightened exposure to operational and compliance risks.

In contrast to public markets, which benefit from decades of refinement and established data standards, private markets remain fragmented, requiring firms to stitch together data and create custom processes.

To overcome these inefficiencies, investment firms need a unified, scalable platform capable of transforming fragmented data into actionable insights while also ensuring compliance with evolving privacy and governance requirements.

Manual Processes Compound the Challenge

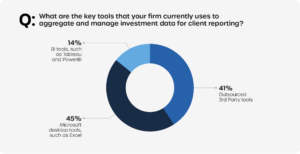

Historically, investment firms have managed data reactively, layering bespoke solutions to meet evolving needs. While this approach addresses immediate challenges, it has led to siloed systems and inefficient, resource-intensive processes that are difficult to scale.

Advances in cloud computing and data governance have improved data quality and centralization for equities and fixed-income markets, enhancing decision-making, reporting, and compliance. However, many firms still face inefficiencies; for instance, 45% of institutional investors rely on manual tools like Excel for client reporting and aggregation, resulting in delays and slower response times.

To bridge these gaps, firms must adopt collaborative platforms that unify data across systems and teams, driving efficiency and scalability in a rapidly evolving investment landscape.

When it comes to alternative assets, the capabilities for less manual-intensive, error-prone processes remain elusive. The fragmented nature of private markets demands a more strategic approach to ensure data quality, accessibility, and usability

*2024 Flash Poll | State of Investment Data Management.” Clearwater Analytics 2024

The Role of Data as a Service (DaaS)

*2024 Flash Poll | State of Investment Data Management.” Clearwater Analytics 2024

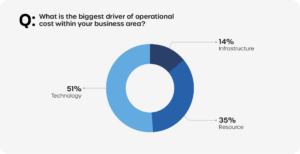

Operational costs in investment firms are heavily influenced by human resources and technology, particularly in the context of data management. As alternative asset investments grow, firms face escalating data and operational complexities. Deploying scalable, cost-effective technology that minimizes reliance on additional human resources is increasingly critical.

Data-as-a-Service (DaaS) offers a transformative solution by centralizing data collection, validation, storage, and governance. This approach helps firms to:

- Reduce operational risks and costs.

- Standardize data formats and streamline data sources.

- Establish a “single source of truth” for more effective decision-making and reporting.

By adopting a DaaS model, firms can focus on their core competencies while benefiting from consolidated, validated, and business-ready data. This not only enhances operational efficiency, it also empowers end clients by providing direct access to actionable insights.

For alternative investments, a unified data framework is vital. Without it, firms risk falling short on reporting requirements, exposing themselves to heightened risks, or missing timely investment opportunities.

Data Collaboration as a Strategic Imperative

Effective data collaboration involves the integration of investment management data with a powerful cloud-based data platform. This streamlines the process of gaining insights and making decisions more efficiently and accurately.

Data collaboration goes beyond centralized storage—it ensures that data is accessible, usable, and actionable across the organization and that different parts of the data ecosystem interact with each other to maximize the data’s value and accessibility for all parties. This is an intrinsic shift in mindset that is driving notable change in the use and management of investment data, and will play a core role in accelerating the usability and accessibility of alternative asset data for firms.

Key Components of this Integration:

- Data Accessibility: Comprehensive investment datasets readily available to users through a centralized data marketplace.

- Seamless Processes: Accurate, timely, and comprehensive data fuels the entire investment management process.

- Operational Efficiency: Direct access to data eliminates the need for multiple data storages, enhancing operational efficiency.

- Advanced AI Tools: The integration leverages advanced AI capabilities to facilitate natural language queries, transforming how teams interact with complex data sets.

A collaborative data strategy ultimately delivers business-ready data to facilitate business objectives and empowers firms to:

- Streamline internal and external reporting processes

- Enhance decision-making capabilities

- Respond efficiently to client inquiries.

Real-Time Access and Flexibility

Effective data collaboration across the management process enables teams to extract on-demand insights by integrating structured and unstructured data from diverse sources. Firms can combine proprietary data with external benchmarks into a business-ready format, analyze disparate datasets comprehensively, and deliver detailed, crossreferenced reports in real time.

With a consolidated warehouse and a financial domain-specific data model, links between datasets are defined once, automatically transformed, and readily available for reporting. For example, comparing a private equity fund against a benchmark could highlight sector value breakdowns between the two, offering actionable insights.

The ability to access and analyze data accurately in real time empowers firms to make informed decisions, improve performance, strengthen client relationships, and attract greater investment flows. Enhanced reporting at management, board, and regulatory levels also reduces resource requirements while fostering transparency and clear communication.

Effective Data Collaboration Drives Improved Customer Engagement

*2024 Flash Poll | State of Investment Data Management.” Clearwater Analytics 2024

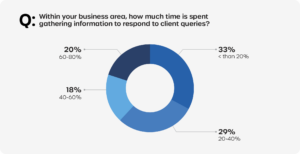

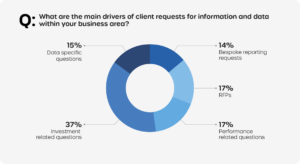

Our data reveals that 38% of firms spend over 40% of their time gathering data to answer client queries, with 20% dedicating more than 60% of their time to this task. Investment firms often serve large, complex clients who face significant reporting, regulatory, and governance demands of their own. As firms diversify into new asset classes, products, and services, they need to access precise answers to intricate questions—far beyond total asset values at a given time. Effective data collaboration enables firms to quickly and accurately deliver detailed, user-friendly reports on issues ranging from exposure types to investment breakdowns.

The Broader Implications of Collaboration

Collaboration extends beyond internal operations. Sharing anonymized, industry-wide benchmarks and data fosters innovation, enhances regulatory compliance, and improves the predictive accuracy of market analysis. Firms that integrate external datasets with internal analytics gain a significant edge in understanding market trends and client behavior.

AI — Transforming Data Management and Interaction

Managing alternative asset data and enabling seamless collaboration demands solutions beyond traditional tools. AI, including generative AI, offers transformative capabilities to address these challenges.

AI for Data Integration and Normalization

AI simplifies and enhances the management of diverse and unstructured data, particularly for alternative assets:

- Data Structuring: AI pulls information from unstructured data formats like PDFs and spreadsheets, and converts it into standardized usable data. This is crucial for private asset data, often delivered in inconsistent formats by limited or general partners.

- Aggregation: Advanced algorithms connect siloed datasets across accounting engines, analytics platforms, and other sources to establish a consistent, comprehensive “single source of truth.” While challenging for public data, this has been even more difficult for fragmented and unstructured alternative asset data.

- Scalability: AI handles growing data volumes efficiently, offering cost-effective scalability. In contrast, manual processes require unsustainable resource investments as firms allocate more assets to alternatives.

Generative AI for Query Resolution

Investment firms must address complex queries for internal processes or client demands—a task that is often timeconsuming and challenging. Generative AI, powered by large language models, revolutionizes this by enabling a new way of interacting with data. Instead of manually extracting and analyzing data, generative AI combines an advanced understanding of underlying data and applications with a natural language query system.

Users can pose complex requests like:

- “What is the total exposure to renewable energy across all portfolios?”

- “Provide a breakdown of investments by geographic region for Q4.”

Generative AI quickly delivers answers with supporting reports or visualizations through a conversational interface. This eliminates the need to search for, collate, and review multiple data points, making data more accessible and actionable for all teams.

By bridging the gap between technical teams (who understand the data but may lack business context) and business teams (who know what to ask but not how to access the data), generative AI empowers users to act as skilled data specialists. It enhances their expertise with deep insights, transforming how data is leveraged across the firm.

Conclusion

The growing prominence of alternative assets brings both significant opportunities and operational complexities. Managing fragmented, unstructured data while meeting client and regulatory demands requires a fresh approach. Traditional systems and manual processes are no longer sufficient to support the scale and intricacy of modern investment portfolios.

A reimagined data management strategy—centered on integration, collaboration, and advanced tools like AI— offers a clear path forward. By adopting scalable, automated solutions, firms can enhance efficiency, ensure realtime access to actionable insights, and allocate resources more effectively. Generative AI further accelerates this transformation by enabling intuitive data interactions, empowering teams to access critical information with speed and accuracy.

The future of investment management will be defined by firms’ ability to adapt to these demands, leveraging innovative technologies to streamline operations and unlock the full potential of alternative assets. By taking these steps, firms can position themselves to meet evolving client needs, navigate regulatory requirements, and support strategic growth in an increasingly complex market.

Download a PDF version of Redefining Data Management for Alternative Assets.

*An advisor’s guide to alternative investments. (n.d.). institutional.fidelity.com. https://institutional.fidelity.com/advisors/insights/spotlights/an-advisors-guide-to-alternative-investments

**McVey, Henry H. 2024. “An Alternative Perspective: Past, Present, and Future.” KKR. September 25, 2024. https://www.kkr.com/insights/alternative-perspective-past-present-future

*** “2024 Flash Poll | State of Investment Data Management.” Clearwater Analytics 2024

Data in this whitepaper includes insights from a 2024 survey of 365 executives supported by comprehensive research and analysis. The surveyed organizations manage a wide range of assets, from under $20 billion to over $1 trillion. Although responses were gathered globally, the majority were from U.S.-based executives.

©2025 Clearwater Analytics. All rights reserved. This material is for information purposes only. Clearwater makes no warranties, express or implied, in this summary. All technologies described herein are registered trademarks of their respective owners in the United States and/or other countries. 1/25

Table of Contents

- Introduction

- New Assets Demand New Data Solutions

- The Historical Perspective

- The Role of Data as a Service (DaaS)

- Data Collaboration as a Strategic Imperative

- Key Components of this Integration

- Real-Time Access and Flexibility

- Effective Data Collaboration Drives Improved Customer Engagement

- The Broader Implications of Collaboration

- AI — Transforming Data Management and Interaction

- AI for Data Integration and Normalization

- Generative AI for Query Resolution

- Conclusion