Download a PDF version of Insurance Asset Management Outsourcing Trends 2025.

A decade of insights from the Insurance Investment Outsourcing Report

The Insurance Investment Outsourcing Report (IIOR) is now in its 12th year of continuous publication, and continues to grow in both prominence and participants. Designed and managed by DCS Financial and published by Clearwater Analytics, the IIOR is built with their deep insurance investment expertise and presence in the industry.

This special report is a summary of IIOR trends and insights from the last 10 years, as well as some current year observations. The 2025 IIOR data used in this report includes 90 participating insurance asset managers and 10 investment consultants.

Trends and analyses from the IIOR allow insurers to understand shifting dynamics, benchmark their investment strategy, and identify potential insurance investment managers. We trust you will find this special report and the full IIOR interesting and beneficial.

We encourage you to download this year’s full report here.

AUM data and analyses in this report is exclusively 3rd-Party General Account Insurance Assets (unless otherwise noted)

ABOUT THE EDITOR:

Steve is a leading expert on insurance investing. He has worked in the industry for more than two decades, both in insurance asset management and at an insurer. Steve is both a Strategic Advisor at Clearwater and founder of DCS Financial Consulting. At Clearwater, he helps insurers and asset managers solve their investment accounting, analytics, and reporting challenges. At DCS, he advises this industry on the many nuances of insurance investing. DCS also designs the IIOR format and manages data collection and report creation.

Steve Doire, CPA, CFA, CPCU

stevedoire@clearwateranalytics.com

steve@dcsconsult.net

Observations and analyses

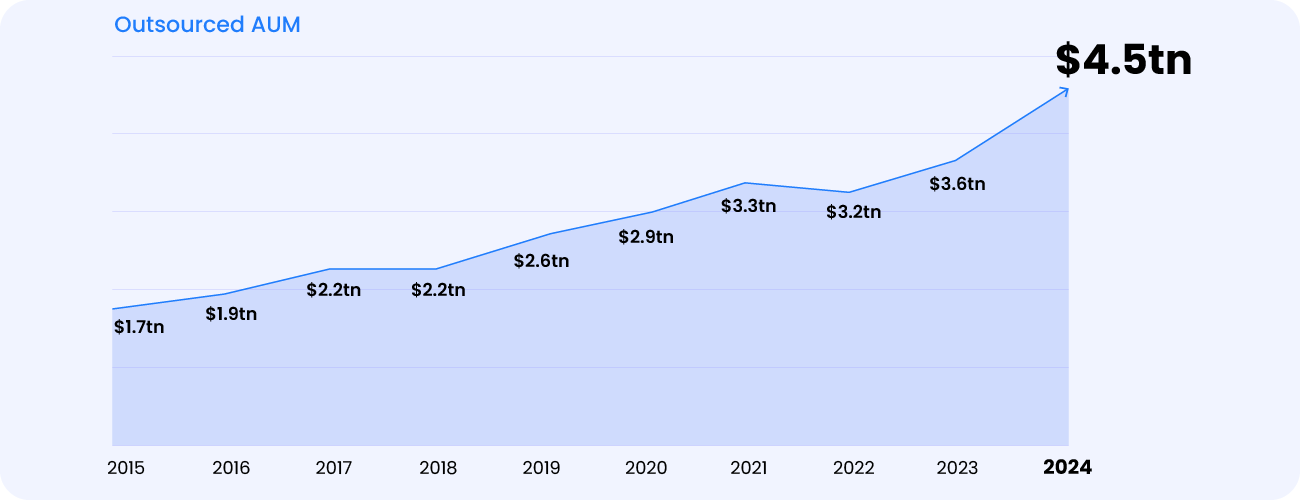

$4.5TN IN AUM REPORTED AND GROWING

The mega trend of insurers engaging external managers continues. AUM growth from 2022 to 2023 set a record at $400bn. 2024 eclipses that with growth of almost $1tn. Insurers have become comfortable outsourcing part or even all of their AUM to external managers. Further, they are adding more asset classes, particularly in private market strategies.

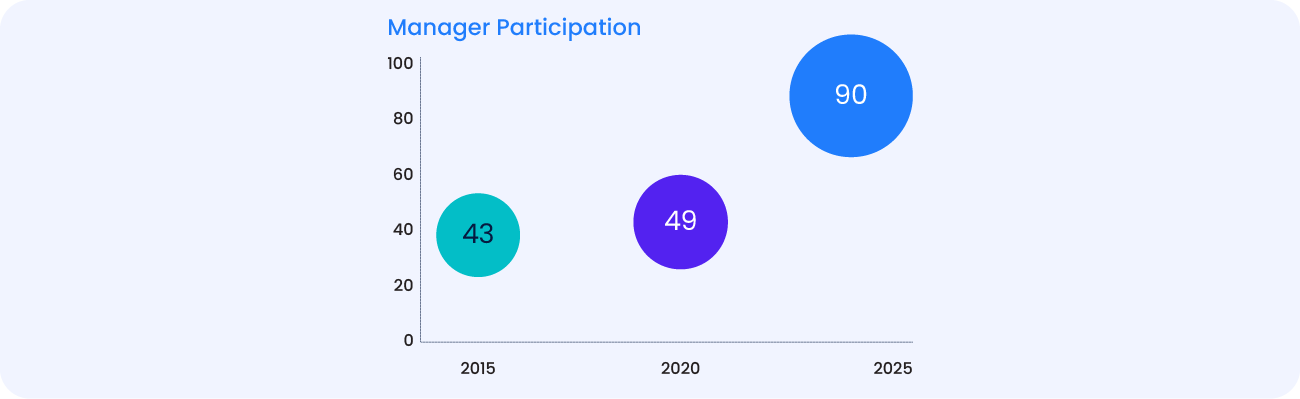

This growth continues to attract managers to the space. The IIOR now includes 90 managers, more than double the number from 10 years ago. It also covers 11 investment consultants who insurers are increasingly relying on to help them build out their strategic asset allocation.

THIRD-PARTY INSURANCE GENERAL ACCOUNT AUM

RECORD PARTICIPATION

Manager participation in the IIOR and the insurance asset management market is growing at unprecedented levels. Many new managers are bringing specialty strategies to insurers. Other managers who have had some insurance presence are increasing their focus on the space and adding resources and capabilities.

We are glad to have a robust and growing list of managers in the IIOR which further increases the value of this insurance investment resource. Many managers come to us and we also identify new ones each year. If you are a manager and would like to join the IIOR for next year, please email the editor.

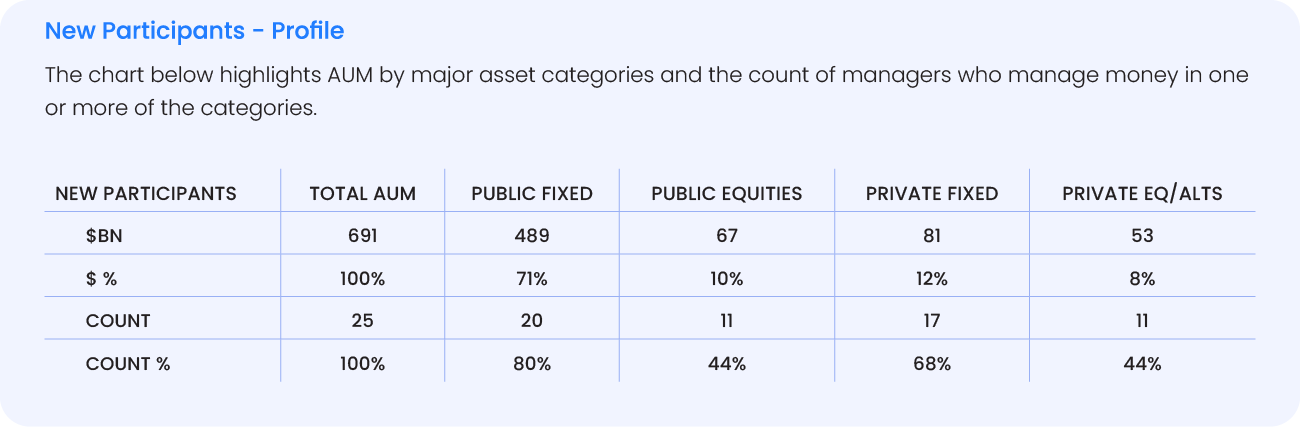

New participant AUM shows an 80/20 dollar split between public and private asset classes. Looking at counts, many new participants manage both public and non-public fixed income. Notably, 68% offer private fixed income capabilities, reflecting its growing importance in outsourcing.

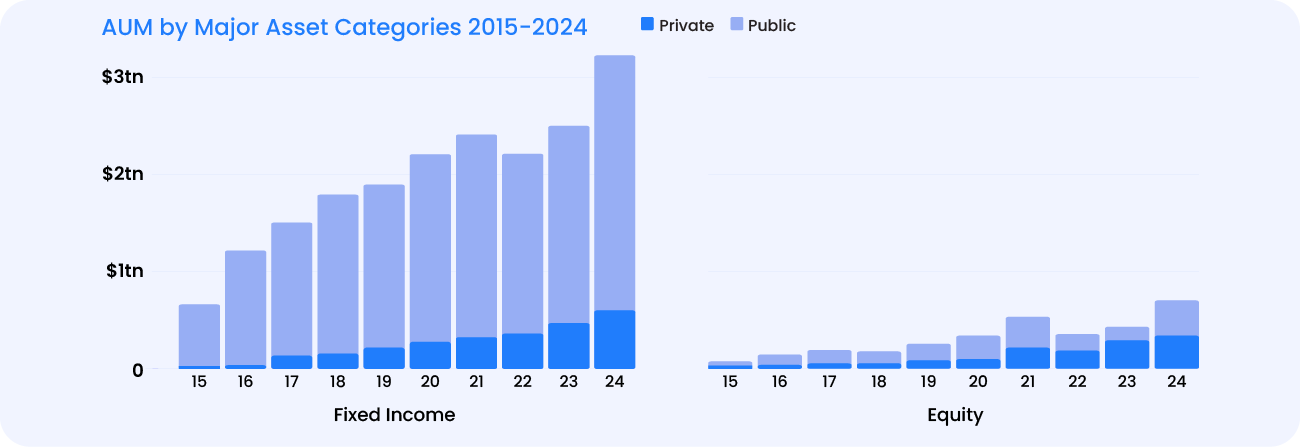

MAJOR ASSET CATEGORY TRENDS

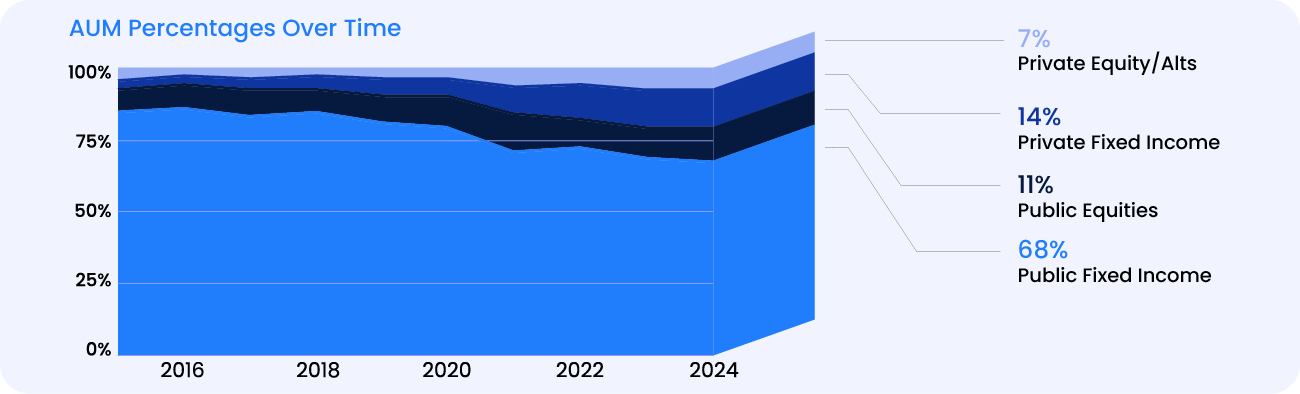

The IIOR collects data from managers in two major categories, public and private, each with two subcategories.

- Public Fixed Income

- Public Equities

- Private Fixed Income

- Private Equities and Equity Alternatives

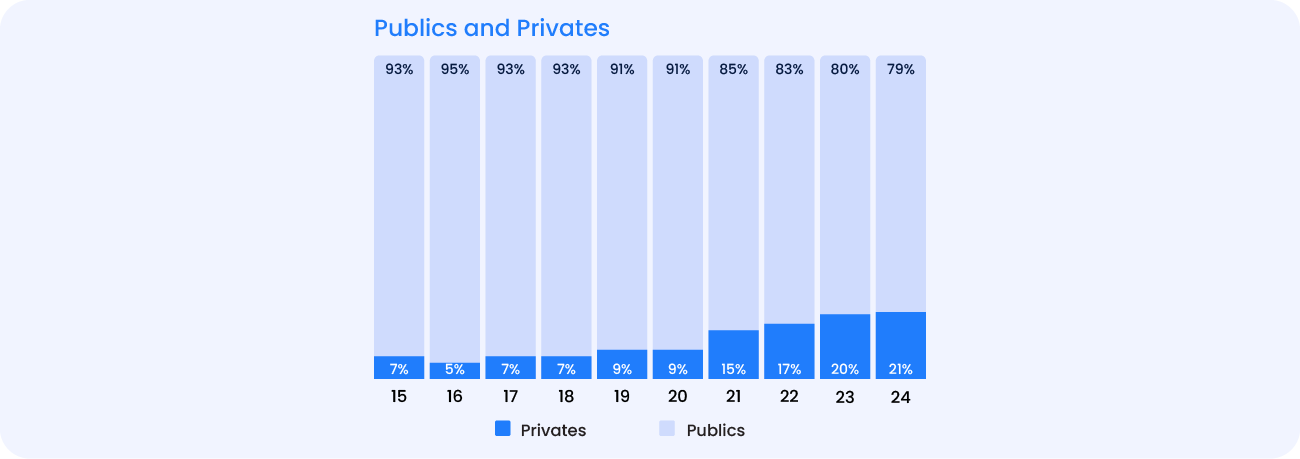

As can be seen in the graph above, public asset classes make up the bulk of the assets. However, there is a clear trend of insurers reallocating meaningful assets into private markets – and external managers delivering the strategies. The private market investment strategies offered and related insurance investment services delivered by managers continue to evolve.

INSURERS LOOK FOR BOTH ASSET CLASS AND INSURANCE INVESTMENT EXPERTISE

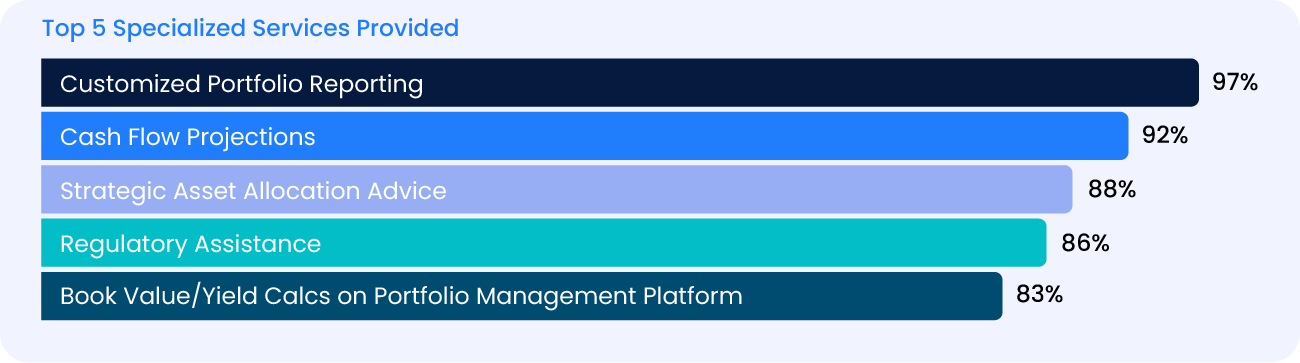

Insurers invest their “balance sheet”, service claims, and are highly regulated. Regulation includes insurance specific accounting like NAIC Statutory Accounting in the U.S. Successful managers invest time and resources to deliver insurance investment expertise to their client relationships. These capabilities have come to be known as “Insurance Solutions” in the industry. In the IIOR, participating managers indicate if they offer insurance asset management solutions services across 14 service categories. The key services most often offered and listed below.

- Customized reporting is a key to understanding how their assets are being invested and managed

- Cash flow projections help insurer match asset cash flows with liability payments

- Developing an appropriate strategic asset allocation in an insurance context is both a challenge and opportunity for insurers, and many managers are there to help

- Regulation and insurance investment accounting metrics surround insurance investing and successful managers help insurers navigate and optimize both

Additional services often offered by managers are listed below – all are offered by 50% or more of the participants:

- Tactical Asset Alloc / Multi-Asset Portfolio Mgt

- Book Income Projections

- Capital Modelling and Management

- ALM Partnering

- Insurance Client Conferences

- Peer Analytics

- ESG Specific Products Placed with Insurers

- Interactive Client Web Portal

Many insurance asset managers partner with Clearwater and leverage our platform to deliver industry leading, insurance investment specific portfolio analytics and a world class reporting platform and web-portal.

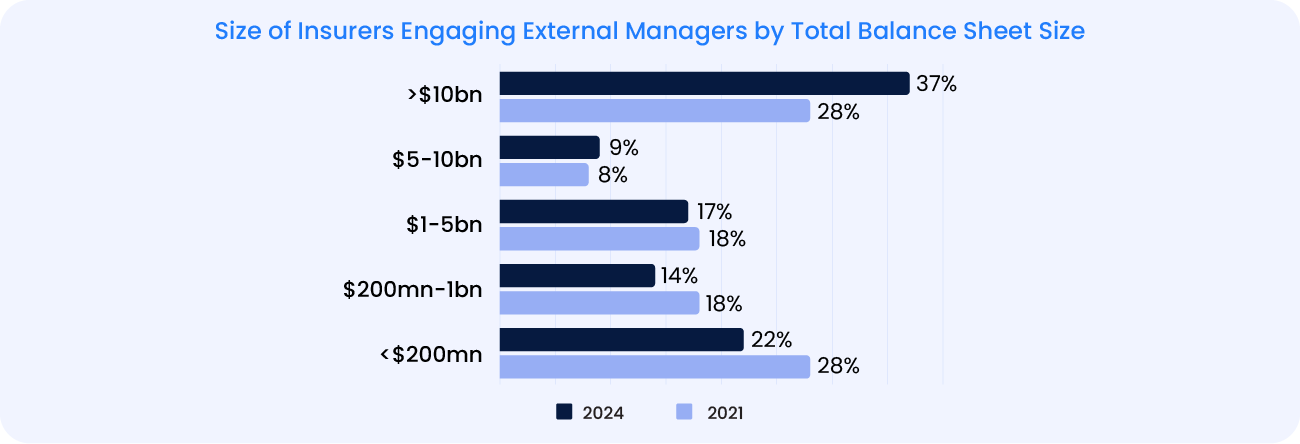

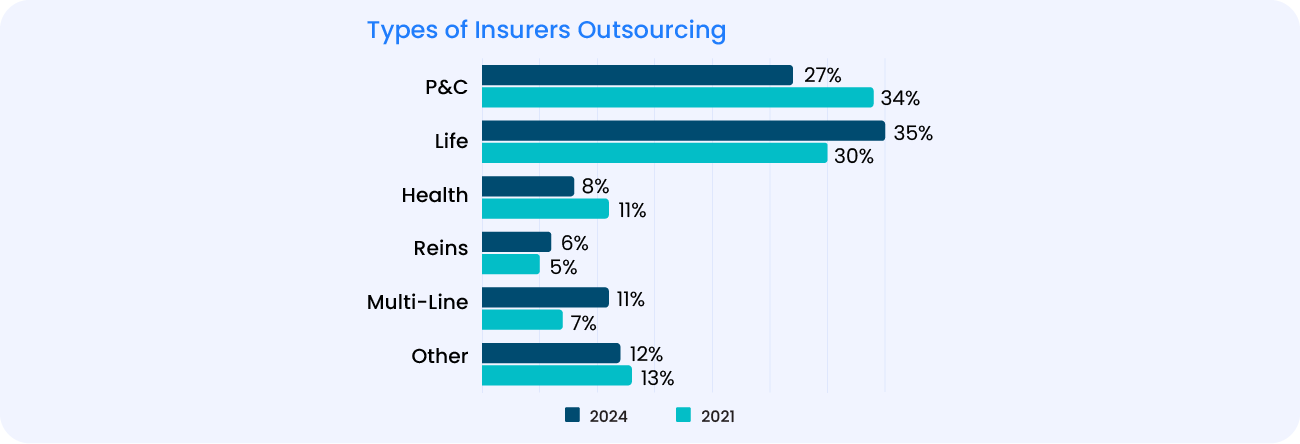

PROFILE OF INSURERS WORKING WITH IIOR PARTICIPATING MANAGERS

Insurers of all types and sizes engage external managers. In the early days of the industry, outsourcing insurers tended to be <$200mn and P&C. Over time both size and type have expanded. In our experience, Insurers that outsource all or most of their assets tend to be below $5bn, with larger insurers, often Life companies, tending to use external managers for specialty asset classes.

Insurers that outsource most or all of their investment management tend to be below $5bn in size and represent about 1/2 of the client base reported by the managers.

P&C, Reinsurers, and Health companies tend to have similar portfolios, with modest duration exposure. Managers often group them together in their process. Life companies have longer liabilities and durations and typically focus on cash flow / ALM management. This requires a different investment strategy for managers to deliver.

GROWTH IN EXTERNAL MANAGER AUM IS ACROSS ALL ASSET CLASSES

As has long been the case, public fixed income is the foundation of insurer portfolios. The asset class provides a liquid market, predictable cash flow, and security. Regulators like these attributes, and it is reflected in their investment limits. While we see insurers reallocating some assets away from public fixed income, it will certainly remain the foundation of insurer portfolios.

Insurers increased their focus on their investment portfolio when they lived through the extended period of low interest rates. Private markets have been a way to add yield and return, and many insurers began to focus on them as an adjunct to their public portfolios – particularly private credit. It started slowly but has gained steam in recent years as evidenced by the numbers below.

PERCENTAGES

DOLLARS

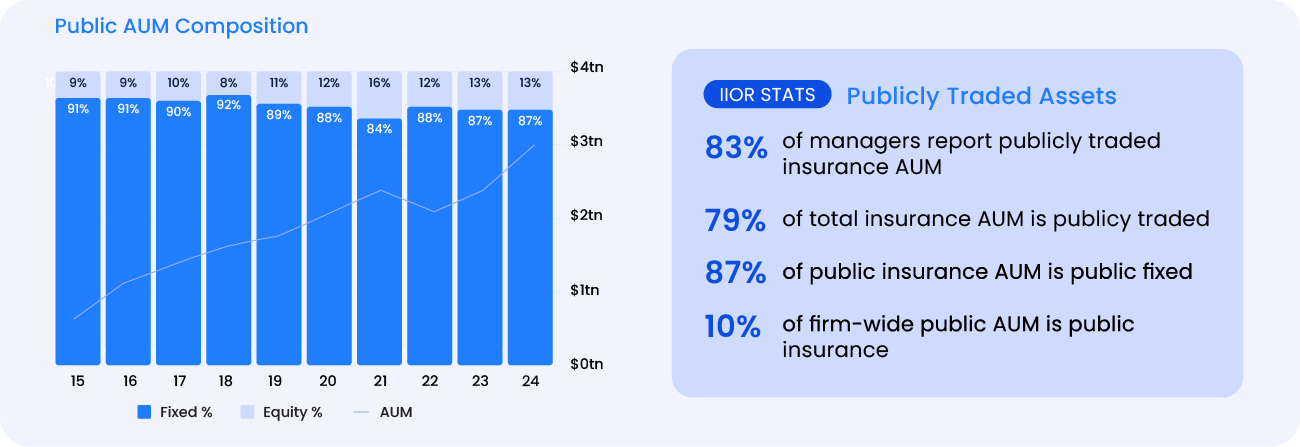

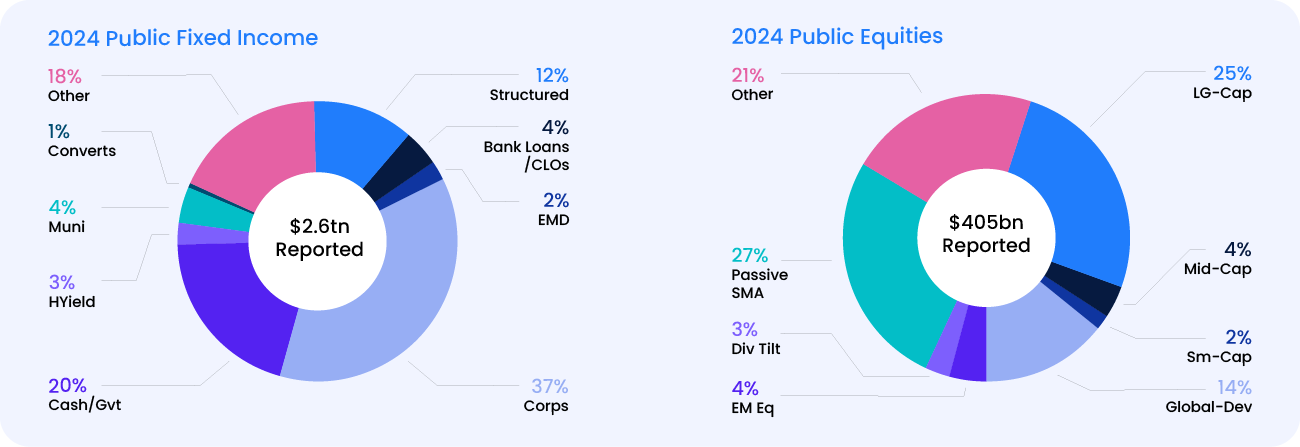

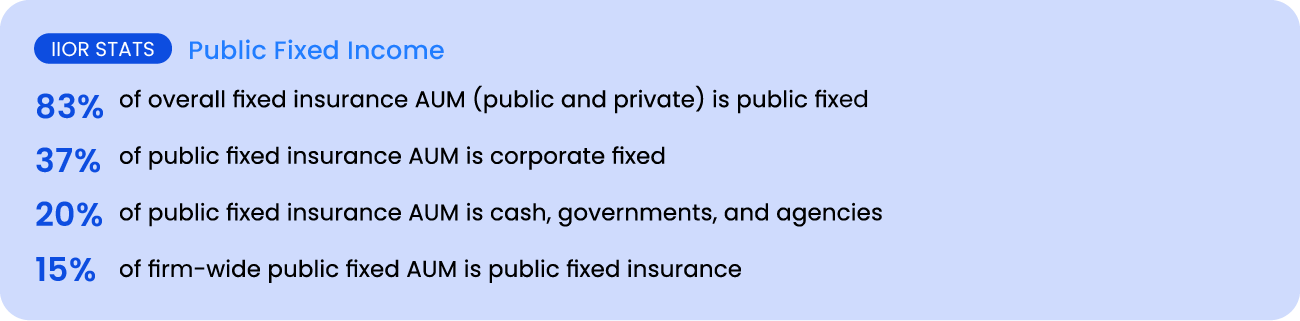

PUBLIC ASSET CLASS TRENDS

68% of this year’s IIOR AUM is public fixed income.

Public fixed income has gradually declined over the decade from 91 percent to 87 percent of total public AUM reported. More than half of this is focused on corporate and government bonds, with the rest distributed across a few other sectors.

In public equities, separately manager accounts (SMAs) are often used to allow insurers to manage gain/loss realization.

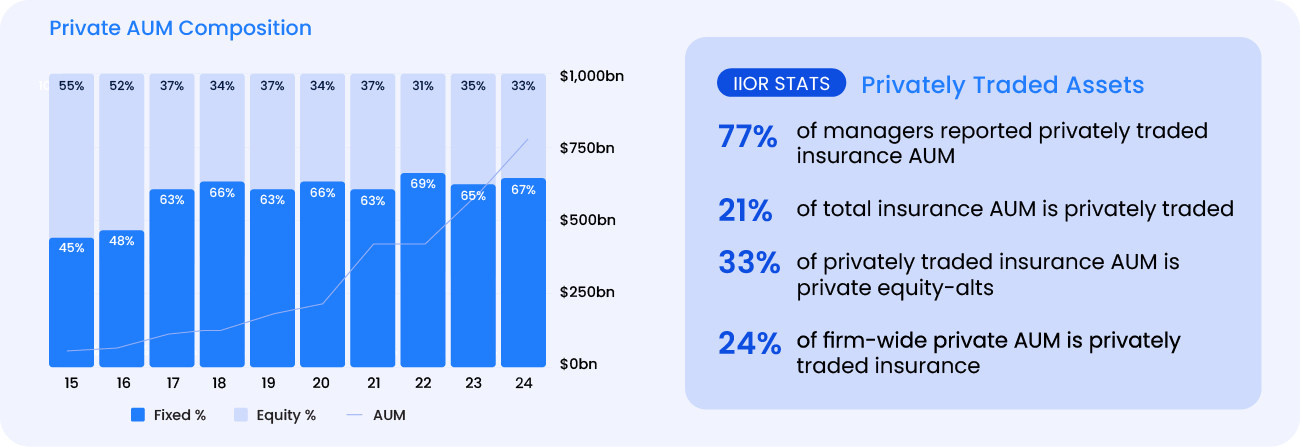

PRIVATE ASSET CLASS TRENDS

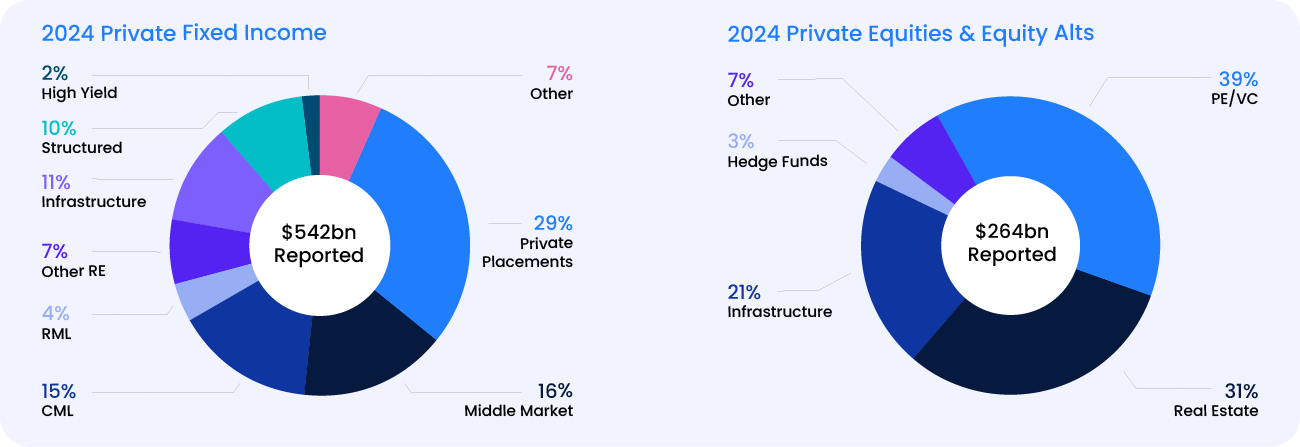

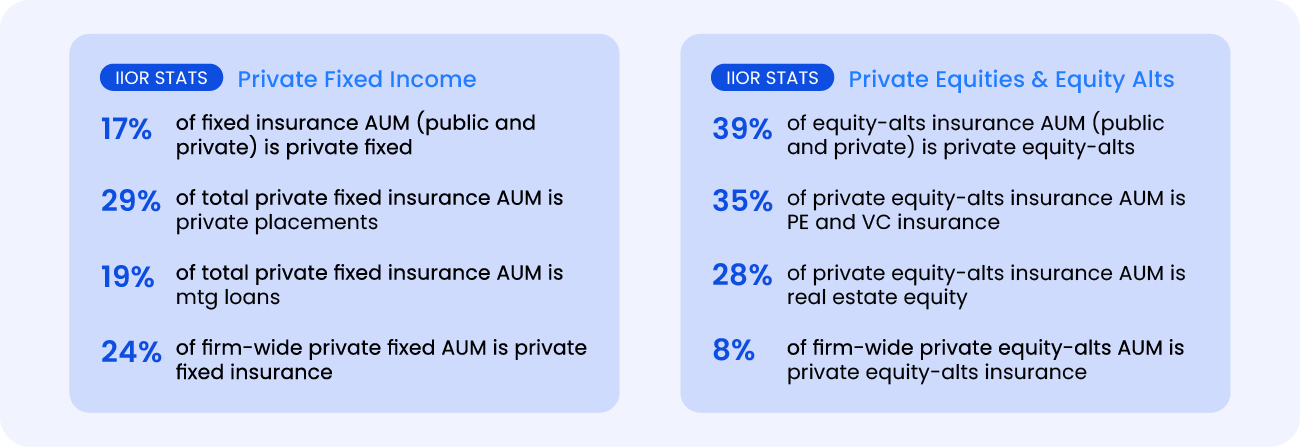

It is not surprising that private fixed income makes up 2/3rds of reported private market strategies. Like public fixed income, it offers a steady stream of income and cash flow – characteristics that insurers focus on.

Within private fixed income, traditional private placements and middle market loans comprise almost half of reported AUM. Whole loans/mortgages also represent material AUM at 19% of the total. Private equities and equity alts focus on 3 major strategies, PE/VC, real estate, and infrastructure.

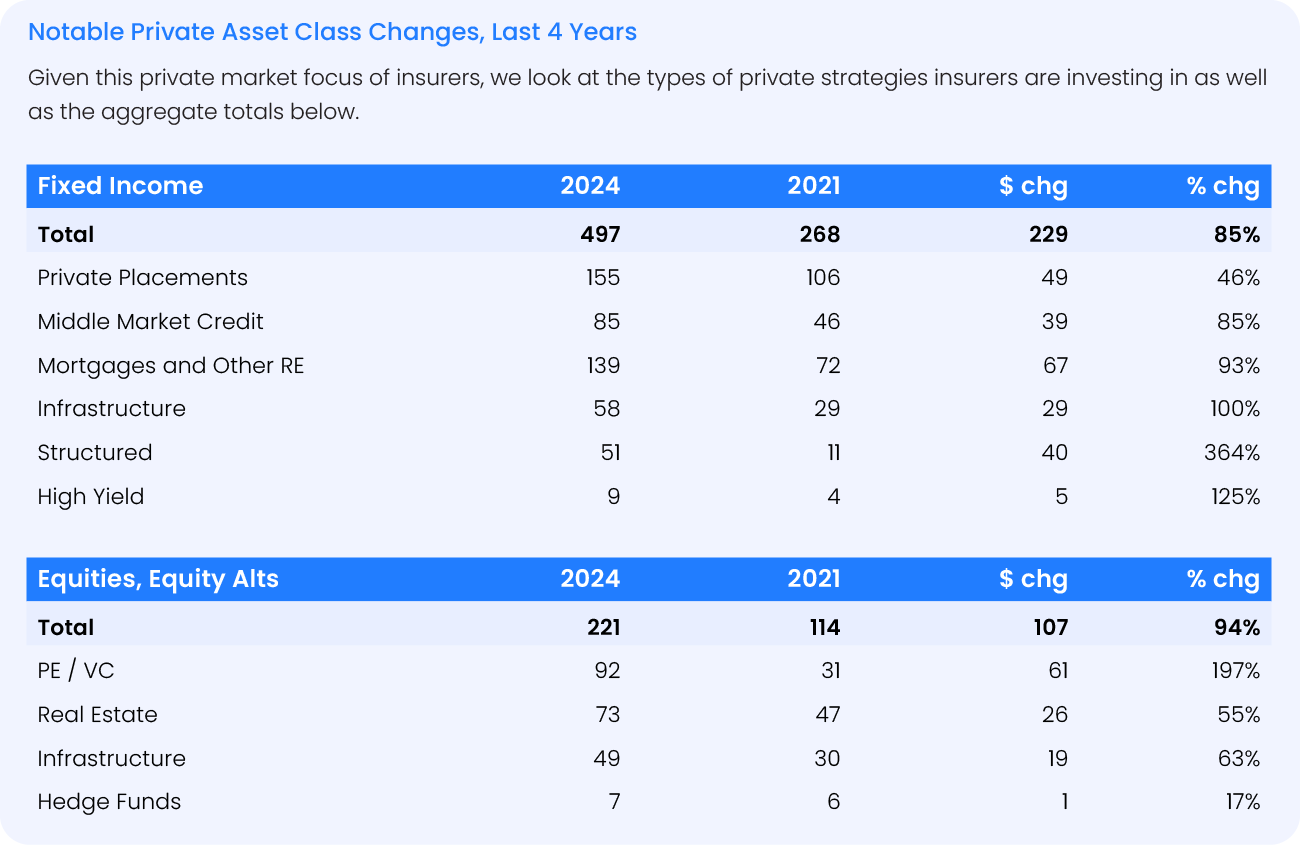

Notable Private Asset Class Changes, Last 4 Years

Given this private market focus of insurers, we look at the types of private strategies insurers are investing in as well as the aggregate totals below.

Concluding Comments

Insurance asset management is a thriving and growing industry. Many insurers have manager relationships that go back more than a decade, but are now adding specialty managers to extend their asset allocation. Insurers across geographies, sizes, and types are leveraging external investment managers for their specialized expertise and cost-efficient scale.

As always, we extend our thanks to the participating managers and consultants who make the IIOR possible.

See you next year!

Contact Steve Doire for any questions or comments on the IIOR or this Trends Report or if you are a manager who would like to participate next year.

stevedoire@clearwateranalytics.com

WE THANK THE 90 MANAGERS and 10 CONSULTANTS WHO PARTICIPATED IN 2025

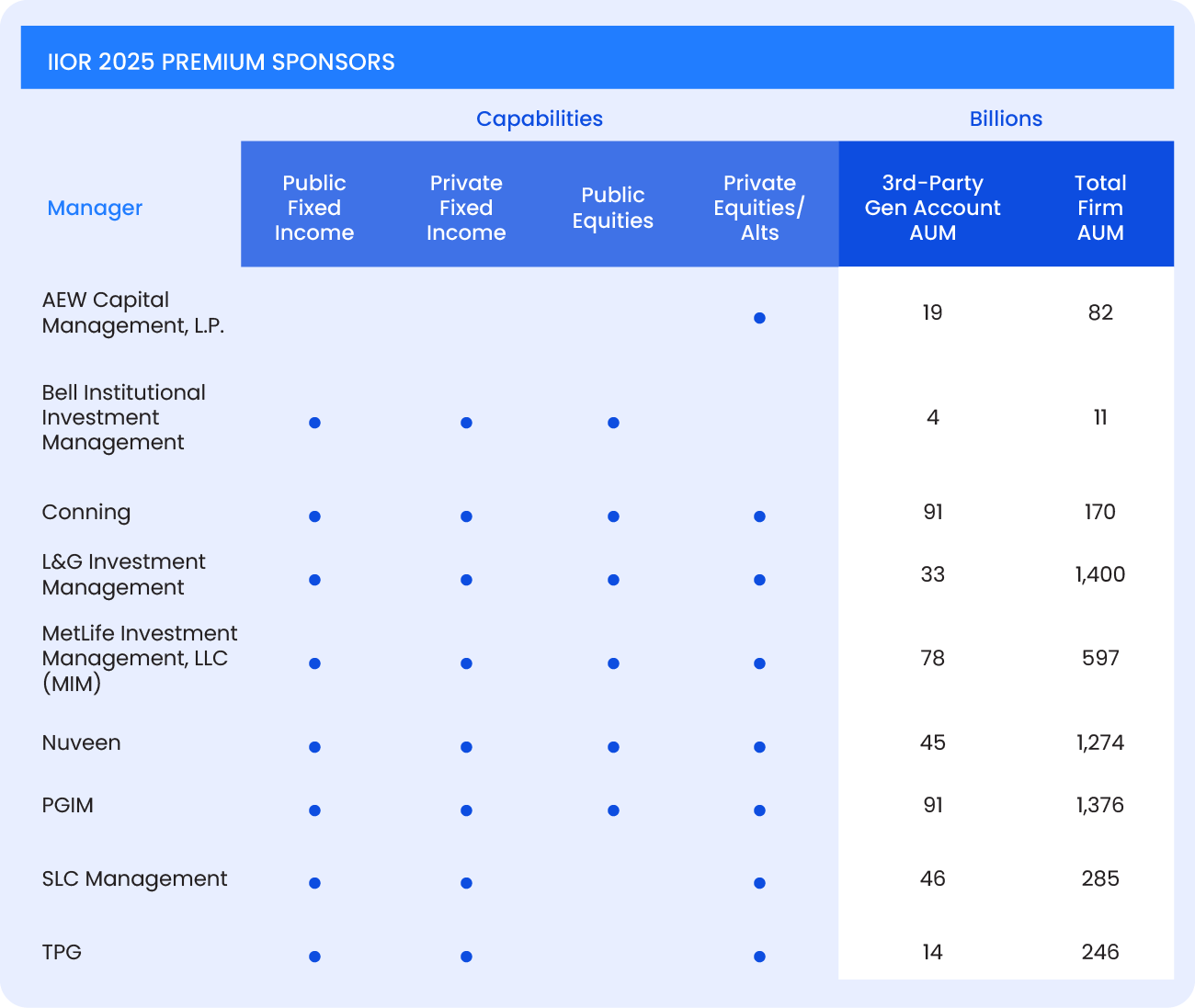

Without them, the IIOR and reports like this would not exist. DCS Financial, the administrator of the IIOR, further thanks all 25 of the IIOR Sponsors, whose support defrays the time and cost of producing the report. Below is a listing of the 11 Premium Sponsors of the IIOR, we ask that you consider them and the other sponsors who support this valued industry resource.

The Insurance Investment Outsourcing Report is a well-known industry resource widely used by insurers researching external managers. Read more about the different investment manager profiles and where your managers rate among the rest.

Download the full 2025 Insurance Investment Outsourcing Report.