Wenzhe Sheng

Senior Product Manager of Regulatory Tech

Wenzhe joined the Clearwater Analytics team in 2022 and is based in our London office. He has more than a decade of experience in investment operations, accounting, and regulations through his experience at J.P. Morgan and GSI-backed life insurance firms. During this time, he was a working member and directly engaged with UK regulators on key regulatory initiatives, such as UK PRA’s Solvency II reform and the Bank of England’s Transforming Data Collection programme.

As a Senior Product Manager, Wenzhe oversees Clearwater’s UK and EU insurance regulatory product and is an expert in helping our clients navigate through the complex and evolving regulations in Europe.

The Solvency II directive has been enforced since 2016 in European countries and became part of the critical decision-making process to European insurers and pension funds for the last 8 years.. European insurers are adjusting their investment decisions, risk management policies, data collection processes, reporting requirements, capital calculations, governance and so on to adapt to the frequent changes by policymakers on Solvency II. Additionally, with the UK leaving the European Union, it creates additional layers of complexity in which European insurers need to consider. For US-based financial institutions, expanding their footprint in Europe is therefore increasingly complex and requires thorough due diligence. Here, we have summarised some of the key elements that US financial institutions need to know, as a start.

What is Solvency II and Solvency UK

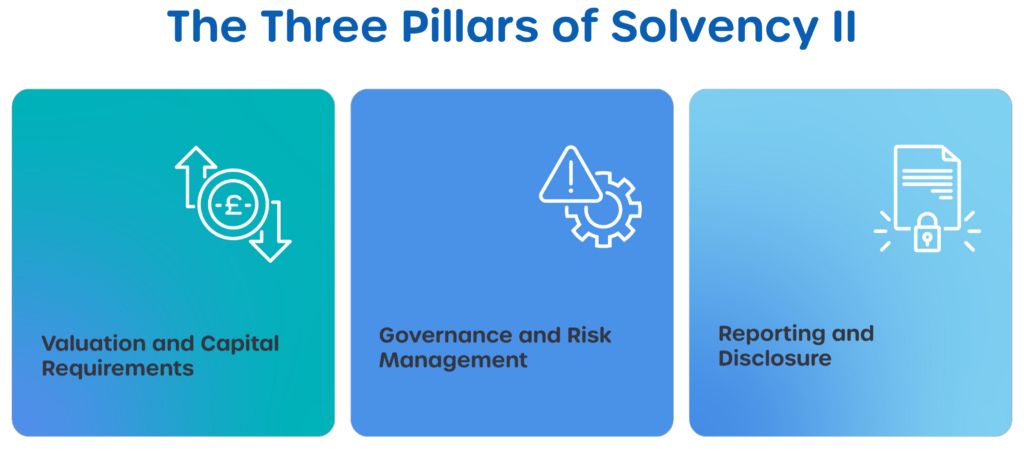

Solvency II is intended to codify and harmonise EU insurance regulation. The directive’s primary goals are to establish a harmonised supervisory regime throughout the EU, provide robust risk management and governance requirements to protect insurance policyholders, increase awareness of internal risks for insurers, and increase understanding of market risks for European regulators. This Solvency II was enacted in 2016 to the countries within the European Union. Since the separation of the UK and European Union, the UK has started to revise the Solvency II regulation and hence, Solvency UK was created.

The crux of Solvency II is the Prudent Person Principle, which places the power—and the responsibility—of an insurer’s investment decisions back in their hands. The Prudent Person Principle replaces the individual country restrictions regarding the composition of an insurer’s investment portfolio, and requires that EU insurers invest only in instruments that have risks they can continuously identify, measure, monitor, manage, control, and report.

What are the direct implications?

The regulation emphasises risk-based approach requirements on EU insurers’ capital holdings, risk monitoring, investment strategy and disclosure transparency. The direct implications to EU insurers involve risk and capital management changes, along with data management processes and systems adaptations. For US financial institutions, the implications will be two fold. Firstly, to enter into the European market, it requires US financial institutions to understand the regulation-driven behaviour in the European market as well as providing expected services that fall under the regulation to their clients or policyholders. Secondly, the continuous discussion between US and European regulators has been leading the US to adopt a risk-based reform in 2025 by NAIC. There is a continuing desire to converge the principles that back the supervisory activities to provide a transparent and level playing field across the border.

US financial institutions with subsidiaries or branches operating in the EU: Any legal entity operating in the EU will need to incorporate aspects of Solvency II. If a subsidiary is in a jurisdiction where the regulatory regime has been certified by the EU, to be equivalent to Solvency II, then the business impact will be less than otherwise. However, under the US’s state-based regulatory model, Solvency II equivalency will vary widely. When Solvency II equivalency isn’t being granted, US subsidiaries will have what is basically an additional reporting basis for their EU operations.

The legal structure will play an important role here in terms of capital and reporting requirement, so when US financial institutions navigate through legal and regulations, they will identify that with inconsistent requirements across the regulatory bodies, meeting Solvency II could have a significant operational, capital and financial impact to US subsidiaries and their group. US financial institutions which operate under Solvency II regulation in Europe ought to consider the extra resource requirements to meet regulatory obligations as well as serving their respective end client in the region. Solvency regulation also requires group disclosure and supervision to protect EU policyholders from risks associated with the wider parent company. Solvency II group supervision focuses on risks relating to the level of group connectivity and inadequacies in readily transferable capital.

Insurance industry and competitive environment: the Solvency II regulation is to create a level playing field in Europe. As a US financial institution operating in Europe, it will not be disadvantaged by complying with regulations from the competitive perspective. However, it will be required to swiftly adapt any economic and regulatory changes, and we have seen high frequency of consultations on various issues since Solvency’s inception.

Solvency II requires that EU-operated insurers focus more on risk and performance management. In an insurance environment increasingly looking for cross-border assets, different regulation by region possesses a challenge to US-based financial institutions.

Regulatory changes: The NAIC Solvency Modernisation Initiative (SMI) has been tasked with improving the US solvency framework. There are significant links between this initiative and Solvency II, as the NAIC looks to the example of Solvency II’s enhanced governance and standards. We have seen this development coming close to the end of its process and the 2025 NAIC update will shift to the risk and principle-based approach, similar to Solvency II. However, regulatory bodies in the US and EU have not agreed to the same set of rulebooks, meaning differences will be there and companies operating cross-border will need to capture all these regulatory differences and changes.

What are the indirect implications?

In the UK and Europe, the regulatory bodies such as the FCA and EIOPA both emphasise on the data record keeping, spreadsheet management, and data quality/integrity. They report that “spreadsheets provide a key area of risk because they are typically not owned by IT, but by other business or control areas. They may not therefore be subject to the same IT general controls as firms’ formal IT systems (i.e. change controls, disaster recovery planning, security etc.).” As data requirements expand and become more complex, reliable and error-free communication becomes even more important. System data integration and communication across global teams can cause significant pitfalls.

What’s Next?

In Europe, the Solvency II regulatory reform result is already effective. There are planned smaller changes in the next few years. One of the current hot topics is to digitalise the reporting cycle, however, we are yet to see what actions the insurers ought to take as a result of this digitalisation.

On the UK side, the reform is still ongoing. There have been several consultations in the past few years, and we should expect a firmer response from the regulatory and UK parliament this year. The UK will continue to innovate its financial market and as a result the regulatory rulebook will continue to change in order to help and supervise those activities. Similarly, the UK has also started the second phase of engagement with the industry in digitalising its reporting process.

For more information on Solvency II and other regulatory changes, visit our Solvency II Hub and read the resources below.