Yuriy Shterk

Global Head of Alternative Assets

Yuriy Shterk leads Clearwater’s global alternatives team, focusing on providing a best-in-class, front-to-back platform tailored for the unique challenges and opportunities presented by alternative assets. Yuriy brings a wealth of expertise from his 25-year career experience in the alternative assets sector. His career includes leadership positions where he led product and solution development for the private markets, derivatives, and the broader alternative assets market, building a deep understanding of client needs in these areas. Prior to joining Clearwater, Yuriy served as Chief Product Officer at Allvue Systems, responsible for growing alternative asset revenue streams. Prior to Allvue Systems, Yuriy served as Head of Product Management for Derivatives at Fidessa, along with multiple leadership roles at CQG.

The steady rise of alternative assets represents a structural shift in how institutional portfolios are constructed. Persistent low interest rates, heightened volatility, and macroeconomic uncertainty have impacted conventional fixed income and equity performance, driving investors to adapt their strategies, not only to capitalize on the benefits of alternative assets but also to navigate the complex landscape of regulatory and operational challenges that accompany these investments.

Once viewed primarily as a complement to traditional asset classes, alternatives are now a core component of institutional portfolios, prized for their ability to deliver diversification, inflation protection, and enhanced yield. But with this shift comes new expectations: Investors are eager for management solutions that reflect a more nuanced understanding of their regulatory constraints, liquidity needs, and operational frameworks.

Increasing Allocations Despite Liquidity Challenges

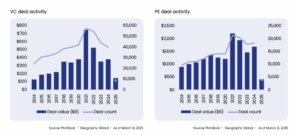

However, as institutional portfolios evolve, the increased focus on alternatives is not without its challenges. Our latest report The Rise of Alternatives: Access, Liquidity and Opportunity, in partnership with Pitchbook, provides an in-depth analysis of capital growth, deal activity, and yields across global markets over the past few years. Notably, since the peak in 2021, venture capital (VC) and private equity (PE) deals have dropped by up to 30 percent in deal count and 50 percent in value, putting greater strain on private investment decisions.

Despite these trends, however, insurance-focused investment managers have expanded their private market allocations from 15 percent to 21 percent, representing over $800 billion in capital that is increasingly tied up for longer, necessitating novel methods of managing liquidity.

Figure 1: VC and PE deal activity, The Rise of Alternatives, Clearwater Analytics, 2025

One approach to improving liquidity management has been the creation of evergreen funds that provide periodic redemption schedules of perpetually renewing investments in a variety of private assets. More than $420 billion has already been invested in these vehicles, and they are projected to grow by more than 20 percent per year over the next five years.

Managing investments in these types of funds, however, requires portfolio and risk management solutions that can handle more complex and customizable definitions for instruments, cashflows, and contract terms. The strategies and infrastructure investors rely on to effectively navigate the complexities will have to evolve.

How technology enhances private fund management efficiency

Advancements in technology have significantly transformed the management of private funds, enabling investors to navigate the complexities of alternative assets with greater ease and efficiency. Robust data analytics platforms allow for real-time monitoring and analysis of portfolio performance, facilitating more informed decision-making. Additionally, these technological innovations support the use of complex fund structures, such as evergreen funds and multi-asset vehicles, which cater to diverse investment goals and mandates.

By automating processes and enhancing transparency, technology empowers investors to optimize their strategies, mitigate risks, and ultimately align their portfolios more closely with evolving market conditions and regulatory requirements.

Leveraging 10-years of data, powered by Pitchbook, our latest report “The Rise of Alternatives: Access, Liquidity, and Opportunity” provides a detailed analysis of why private markets are growing, where the money is coming from, and how investment managers are incorporating these less-liquid assets into portfolios.

You can download the full report from here.