Fed Holds Tight

Today, the Federal Reserve opted to maintain its policy rate at a target range of 4.25% to 4.5%, where it has lingered since December 2024. This move was widely anticipated by markets, which currently price three additional rate cuts by year-end. Should these cuts materialize, the target rate will settle near 3.5% by December, within vaguely restrictive territory, given neutral policy rate estimates (r*) of 3% to 3.5%.

This was, in many respects, an easy decision. With the labor market showing few signs of weakness and inflation persisting above the Fed’s 2% target, policymakers remain focused on restraining economic activity. Despite several years of recession calls by many experts, this approach has manifested in an elusive soft landing. Tight monetary policy has been a boon, not a bust.

The Fed’s upcoming decisions will be far more challenging, however, given the uncertain outlook marked by a U.S. trade policy in flux. Putting it lightly, as the Fed itself acknowledged in its published statement, “The risks of higher unemployment and higher inflation have risen.”

Policymakers Don’t Know Any More Than We Do

While today’s decision aligns with a resilient macroeconomic landscape, the horizon for monetary policy remains clouded by uncertainties surrounding tariff policy. Tariff clarity and severity are the key themes for 2025. Investors and business leaders face uncertain timelines, and implicated (or exempt) trade partners/goods remain unknown. The resulting indecision has already impacted the real economy.

As for severity, questions linger about how high U.S. tariff rates—and foreign responses—will climb. With rates north of 100% on both sides of the Pacific, trade between China and the U.S. has already declined materially. What will happen to U.S. relations with other trade partners after the 90-day pause?

Tariffs present a complex challenge for the Fed by adding a layer of uncertainty to its inflation battle. Tariffs, being a tax on the consumer, raise prices via cost passthrough from firms. How much firms pass on will test the Fed’s capacity to “look through” this one-off inflation spike, assuming tariffs do not rise again next year.

Tariffs that are high enough, such as those initially proposed on April 2nd, will induce sufficient inflation—enough for the Fed to keep rates higher than currently priced. Consumer and financial markets’ long-term inflation expectations remain well-anchored, which monetary policymakers are keen to maintain.

Will cash outperform?

As noted, markets currently price three additional cuts to the policy rate this year. What’s driving this? An expectation for more Goldilocks jobs reports and easing inflation? Or are investors formulating a middle-ground best guess on a tempered economic outlook disrupted by tariff policy? Probably a little of both.

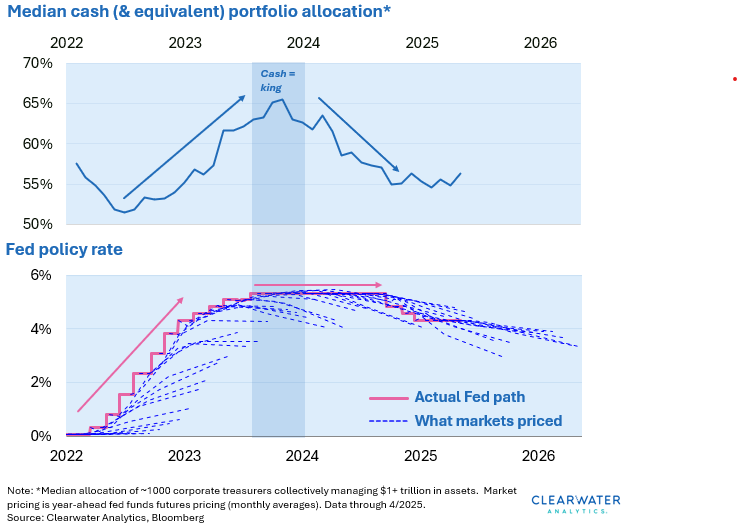

Over the past few years, as rates increased, cash has been a winning strategy for corporate investors in Clearwater’s database. Yet many firms have missed out on better performance. As the chart below shows, corporates appear to have over-indexed on a dovish Fed since 2024. They decreased allocation shares to cash and equivalents—the Fed influences short-term investments most directly—but the Fed has been much slower on the way down than it was on the way up.

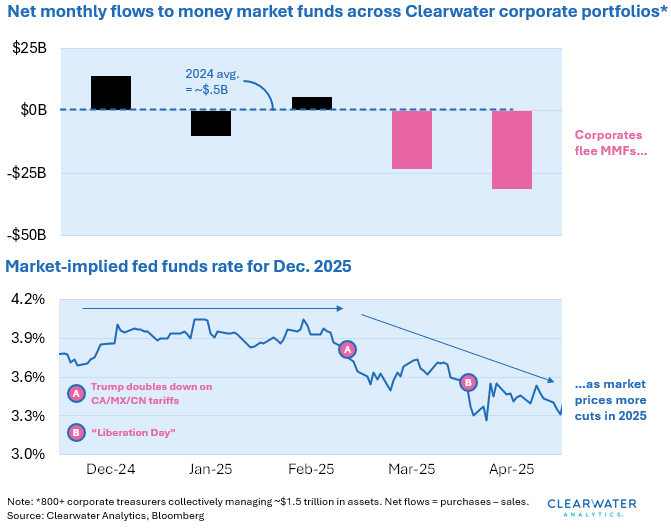

Are investors at risk of repeating the same mistake in 2025? Since the start of the year, our database has shown a notable departure from money market funds (see chart below, upper panel), mirroring a decline in the expected policy rate by year-end (lower panel). While cash might not reign supreme, are corporate investors banking on an overly dovish Fed once again?

What Lies Ahead

Stable engines of resilience currently power the economy. Wage growth and job growth remain robust, conferring spending power to the economy (of course, tariff-induced inflation can and will eat into consumers’ wallets). In addition, credit is not particularly hard to come by. Finally, balance sheets for corporates and households alike continue to hold strong.

While cracks are starting to appear, much hinges on White House policy. If tariffs prove impactful but not overwhelming, the economy will forge ahead on a bumpy path—and likely outperform current expectations. In that scenario, ditching cash investments this year may not be the winning strategy corporate treasurers and CFOs anticipate.