London Interbank Offered Rate (LIBOR) is a benchmark interest rate that is based on borrowing rates by a panel of banks. Currently, LIBOR is used as a reference rate for financial contracts in the cash and derivatives markets.

Due to changes in the financial markets, regulators have called for the use of other benchmarks. The United Kingdom’s Financial Conduct Authority stated that LIBOR will be submitted through the end of 2021. This transition away from LIBOR will lead to major changes in the pricing of financial products. Organizations impacted by this change should start thinking about this transition before the 2021 deadline. Securities can start using a new index at any time. The sooner your organization starts thinking about this change the easier the transition away from LIBOR will be.

Clearwater’s ability to adapt to the market shifting away from a staple such as LIBOR, shows its commitment to staying ahead of market changes and providing exceptional service and data. Our true Software-as-a-Service (SaaS) platform integrates updates to the system seamlessly so users do not experience manual updates or disruption in service.

To facilitate a smooth transition away from the LIBOR index, Clearwater plans to implement analytics and accrual calculations leveraging six new indices by the end of 2020. The 2020 deadline for this development work means that organizations can start to implement new indices for their securities well before the 2021 deadline.

Clearwater product and development teams are working swiftly to develop, implement, and support widely accepted replacement indices, which have been identified by the Alternative Reference Rate Committee (AARC) in the US and equivalent governing bodies in their respective jurisdictions.

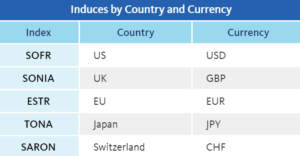

Throughout 2020, Clearwater plans to implement the SOFR, SONIA, ESTR, TONA, and SARON indices as replacements for LIBOR. The specific index that replaces LIBOR is dependent on the individual securities underlying currency. See the table below for more detailed information.

In addition, Clearwater will develop calculation models for the various security types that leverage these indices. This includes both simple and compounding accrual calculations for each index. Simple accrual calculations are calculated on the principal of the security, while compounding accrual calculations are based on the principal amount of the security as well as the accumulated interest of previous periods. The compounding accrual calculation is a new capability for Clearwater and something we are pleased to release to our users. Clearwater also added analytics supporting yield, duration, and convexity for securities that reference these indices.

More information on LIBOR and Clearwater updates to support this transition will be available here, on Clear Insights.