Eric Hall

Data Integrity Team Lead

Eric serves as a Team Lead in the Data Department within Global Operations at Clearwater. In this role, he oversees the Structured Products Desk and Fixed Income Desk within the Asset Class Division. Eric has 20 years of industry experience and uses his background in investment management, fund administration and accounting to comment on regulatory updates and industry changes.

Eric has a bachelor’s degree in accounting from Ottawa University.

London Inter-Bank Offered Rate (LIBOR) is an indicative measure of the average interest rate at which major global banks can borrow from one another. LIBOR is quoted in multiple currencies and multiple time frames using data reported by private-sector banks. LIBOR is used extensively in the U.S. and globally as a “benchmark” or “reference rate” for various commercial and financial contracts, including corporate and municipal bonds and loans, floating rate mortgages, asset-backed securities, consumer loans, interest rate swaps, and other derivatives. (1)

The UK’s Financial Conduct Authority (FCA) is responsible for regulating LIBOR. FCA Chief Executive Andrew Bailey has made clear that the publication of LIBOR is not guaranteed beyond 2021. The Alternative Reference Rates Committee (ARRC) is a group of private-market participants convened by the Federal Reserve Board and the New York Fed to help ensure a successful transition from U.S. dollar (USD) LIBOR to a more robust reference rate. (2) (3)

As regulators and market participants seek to avoid business and market disruptions resulting from the expected discontinuation of LIBOR, implementing alternative reference rates in advance of the discontinuation has taken on urgency. (1)

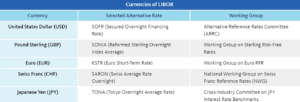

LIBOR is quoted in five major currencies. The alternative reference rate and working group for each is described in the table below:

Considerations for Clearwater Users

Clearwater expects floating products to start linking themselves to the new reference rates through 2020 in anticipation of the change. The process at which this is affected will inform how the transition will be accomplished in 2021, once the publication of LIBOR is no longer guaranteed.

There are two likely scenarios of how issuers will process conversions for the transition:

- No identifier change or exchange required: Clearwater doesn’t expect there to be an impact to holdings.

- Identifier change or exchange required: Clearwater expects to use the Exchange in and Exchange out functionality in place today.

Main aspects of LIBOR currently used on the Clearwater system:

- Cash Flows — Reference index for floating rate securities as interest payments are defined on the underlying LIBOR rate.

- Yield Curves — USD LIBOR/Swap curve is used in OAS and other yield curve calculations.

- Performance Benchmarks — Various LIBOR indexes can be set up to use as a benchmark against an account’s performance.

Clearwater continues to be proactively engaged in research and dialogue to handle the transition, including internal development projects, negotiating required data contracts, and developing new methodologies to ensure accurate calculation and reconciliation based on the new reference rates.