Recently, we have commented on how investors are responding to market volatility in recent weeks, and took a focused look at risk and the types of risk reporting investors are relying on now. In this article, we will explore investors’ approach to impairment, again using trends and data from the Clearwater solution to inform our analysis.

The New Normal

Markets are stabilizing and settling thanks largely to the liquidity infusion to the system supported by the Fed. However, similar to 2008, volatility will persist until there is some resolution in sight to the new circumstances we are all facing in our daily lives.

What is our “new normal?” Answering that requires an assessment of what we view as “temporary” or as “permanent.” As we discussed in our earlier piece, investors were initially focused on the risk factors in their portfolios — duration, credit, issuer exposures — during the first weeks of the COVID-19 event. As time passed and stretched into month-end, that focus on risk has not wavered and may prove to be long-term in nature.

Security Downgrades

Investors weren’t alone in this: rating agencies moved decisively in assessing issuers’ balance sheet risks in March. Within the Clearwater data set (a more-than representative sample) there were 7,560 security downgrades. While we’ve seen extensive downgrades in the past — S&P’s action in 2011, post-2008 financials — March’s downgrades were focused in the corporate market, with 44% attributable to consumer-based and energy holdings. While energy faced a host of exogenous factors prior to COVID-19, the drop in oil prices did nothing to stanch the bad news. Coupled with a pullback in consumer behavior, investors had much to think about as they prepared their financials and board reports for Q1.

Trend Analysis: What We’re Seeing in Clearwater

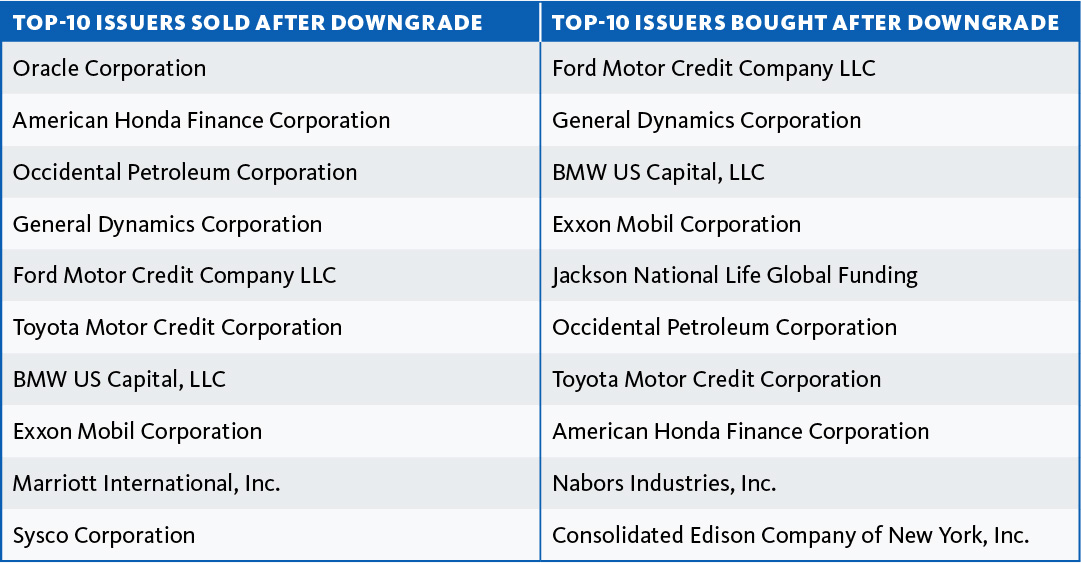

The reaction to this activity is manifest in two interesting trends. The first is trading activity triggered by downgrades. In gauging the market, sellers were de-risking or, in some cases, addressing compliance breaches caused by downgrades. As expected, sectors that saw the largest amount of sellers also attracted opportunistic buyers who were willing to take on risk at price points they believe will produce favorable risk-adjusted returns.

Again, energy and consumer cyclical led the way in both buying and selling; industrials (airlines, equipment, etc.) were also prominent, having come under pressure from business closures and an overall reduction in demand. Another interesting note is that automotive finance arms, which were downgraded due to an expected “credit shock” resulting from distressed borrowers forgoing their car payments to fund other household needs, accounted for four of the top 10 most heavily transacted names subsequent to their downgrades.

However, with some firms still subject to other-than-temporary-impairments (OTTI)* and others preparing for CECL**, those unwilling to accept short-term losses to de-risk must consider which aspects of the current market volatility may be permanent.

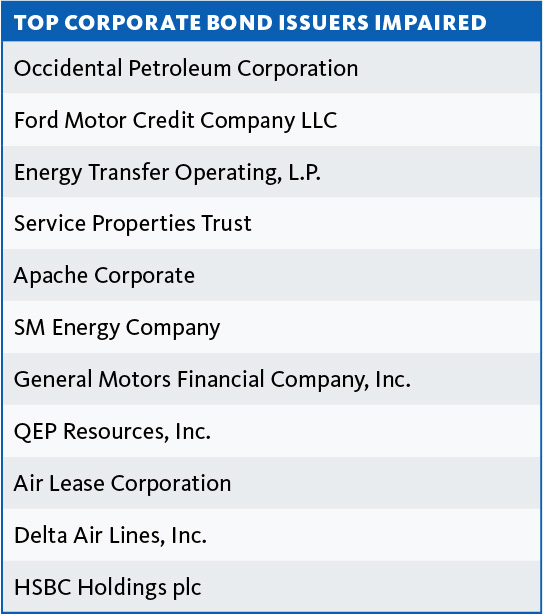

While credit rating was one guidepost, clients also frequently accessed spread details and impairment screening tools offered by Clearwater to inform their action. The result was 12,733 impairment elections on the Clearwater solution for March 2020, compared to only 7,170 in March 2019. Three-quarters of those March 2020 impairments were write-downs related to corporate issuers, as investors incorporated downgrades and anticipated analyst projections for a prolonged recovery that may impact debt servicing and/or further subordinate their holdings in the capital structure. 1,656 issuers were tied to the impairments, and while these were also focused on energy and consumer cyclicals, it’s clear investors are bracing for long-term negative impacts and immunizing their own balance sheets from the risks faced by the issuers they’ve invested in.

Where Investors are Focused Today

While the long-term picture is still coming into focus, this activity has allowed us to have productive conversations with our clients on what we’re seeing and where we can help.

Here is where Clearwater clients seem to be focused at present:

- Both reactive and proactive analysis of credit implications as they pertain to evaluating COVID-19 and energy-related impairments and allowances

- Aggressive immunization of their portfolios to risk either by selling or by impairments

- Seeking to justify actions by monitoring and reacting to their peers — not only the rating agency actions — but peer groups and similar entities

The result was 12,733 impairment elections on the Clearwater solution for March 2020, compared to only 7,170 in March 2019.

We are continually monitoring these flows, and are on the front lines of assisting clients in their impairments through our accounting expertise and data-driven analytics. We will continue to publish our findings here as this evolves and impacts Q2’s impairment activity as well.

How Clearwater Can Help

If you’re reading this, it’s clear you value a data-driven approach to making investment decisions. That is exactly what Clearwater provides, tailored to your particular portfolio, strategy, and potential risks.

Our SaaS solution provides daily access to your investment data. Through automation and innovative technology, your organization’s information (from custodian banks, investment managers, brokers, order management systems, third-party security master data vendors, etc.) is aggregated, reconciled, and available for reporting and analysis each day.

Clearwater is an integrated solution, meaning that different processes and functions are based on that same validated and up-to-date data. Our multi-basis, multi-asset class accounting system feeds our risk reporting and analytics, compliance monitoring, and performance tracking. The system also provides customized and integrated general ledger entries for a variety of reporting constituencies.

Here is a sample of key reports Clearwater users have been leveraging frequently in recent weeks:

- Daily dashboards with portfolio realized and unrealized gain/loss data

- Reports showing top ten gains/losses

- Other-than-temporary-impairments (OTTI) report

- New CECL reporting suite

- General ledger reports

- Credit events

If you would like to learn more about the Clearwater solution, or see a demo of the system, don’t hesitate to get in touch. Our solutions consultants work closely with the world’s biggest institutional investors to understand their unique operational and technology needs. We would appreciate the opportunity to share what we know.

To learn more about how we are helping companies like yours, contact our Solution Consultants Team.

* Non-public, non-SEC filing entities

** Public business entities that are SEC filers and do not qualify as ‘a smaller reporting company’ and follow GAAP accounting