This article is the second in a special series examining how investors are responding to the current market conditions. You can read the first article here.

We frequently ask our clients and other firms we work with how they think about risk. Those conversations reveal experiences with large-scale events like the subprime crisis, the “dot-com bubble,” and other historical bouts of volatility that have shaped how investors think about risk and provide models to apply to current portfolios. But the COVID-19 pandemic is a unique situation. Although markets are behaving similar to historical parallels, there is a lack of precedence for a global pandemic affecting so many of the world’s developed economies.

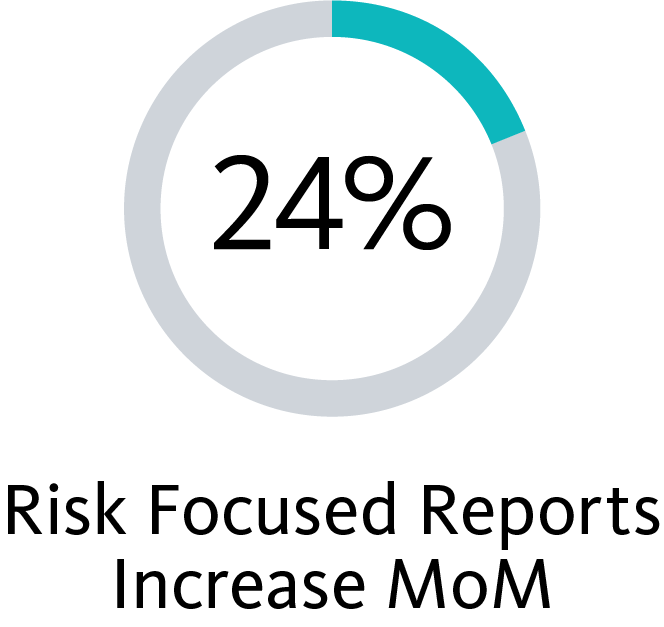

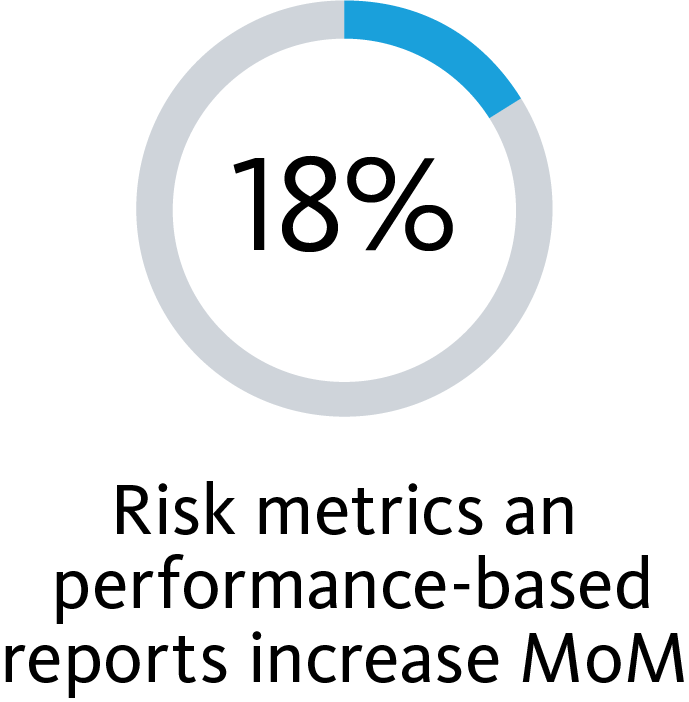

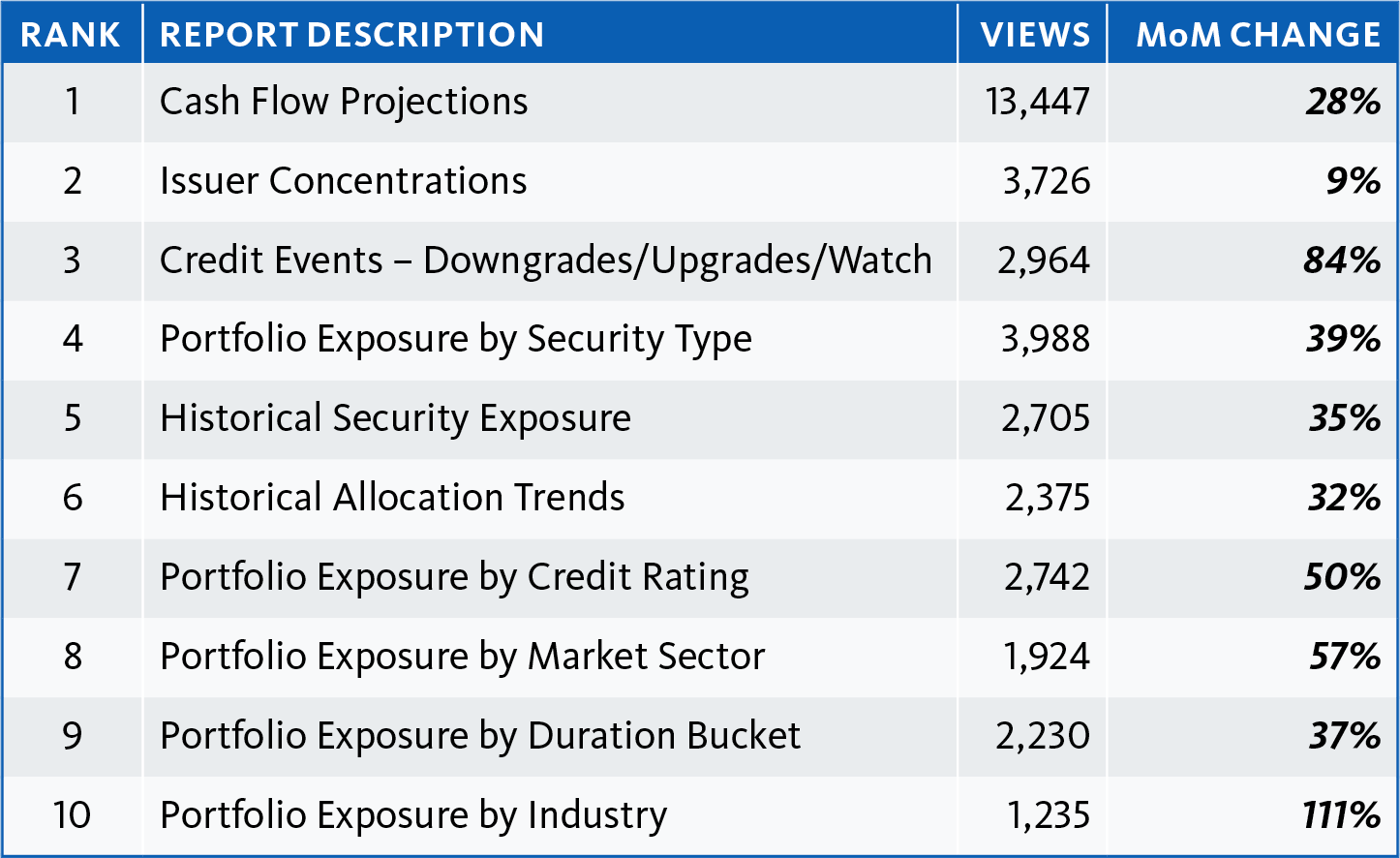

As part of our ongoing analysis of how investors are responding to the current conditions, we examined reporting trends on the Clearwater platform during the month of March by measuring the increases to our most frequently accessed reports. Reports focused on risk metrics led the way by a significant margin with a 24% increase month over month. Dashboards, which often feature a compilation of risk metrics and performance-based reports, had an 18% increase month over month.

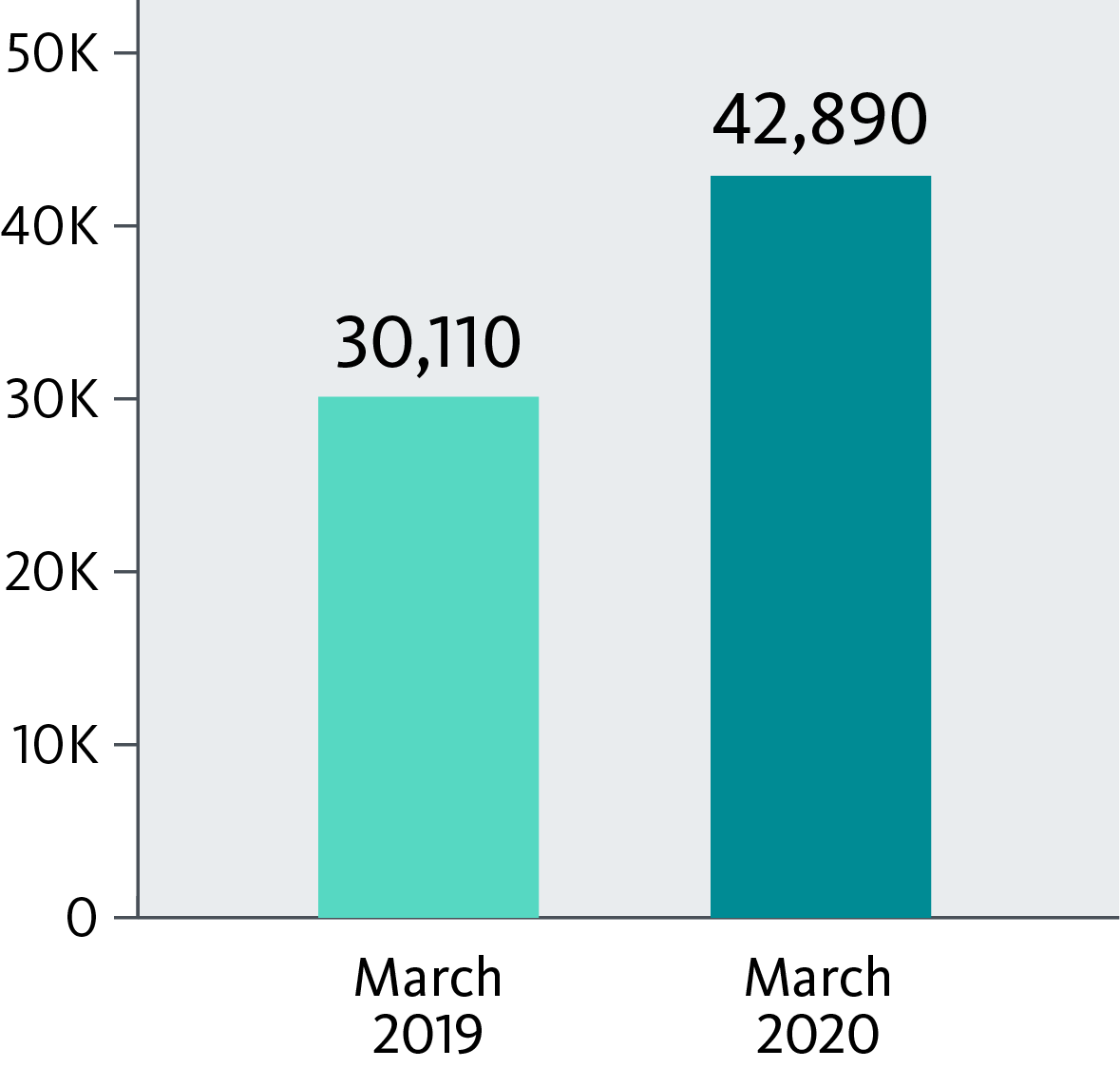

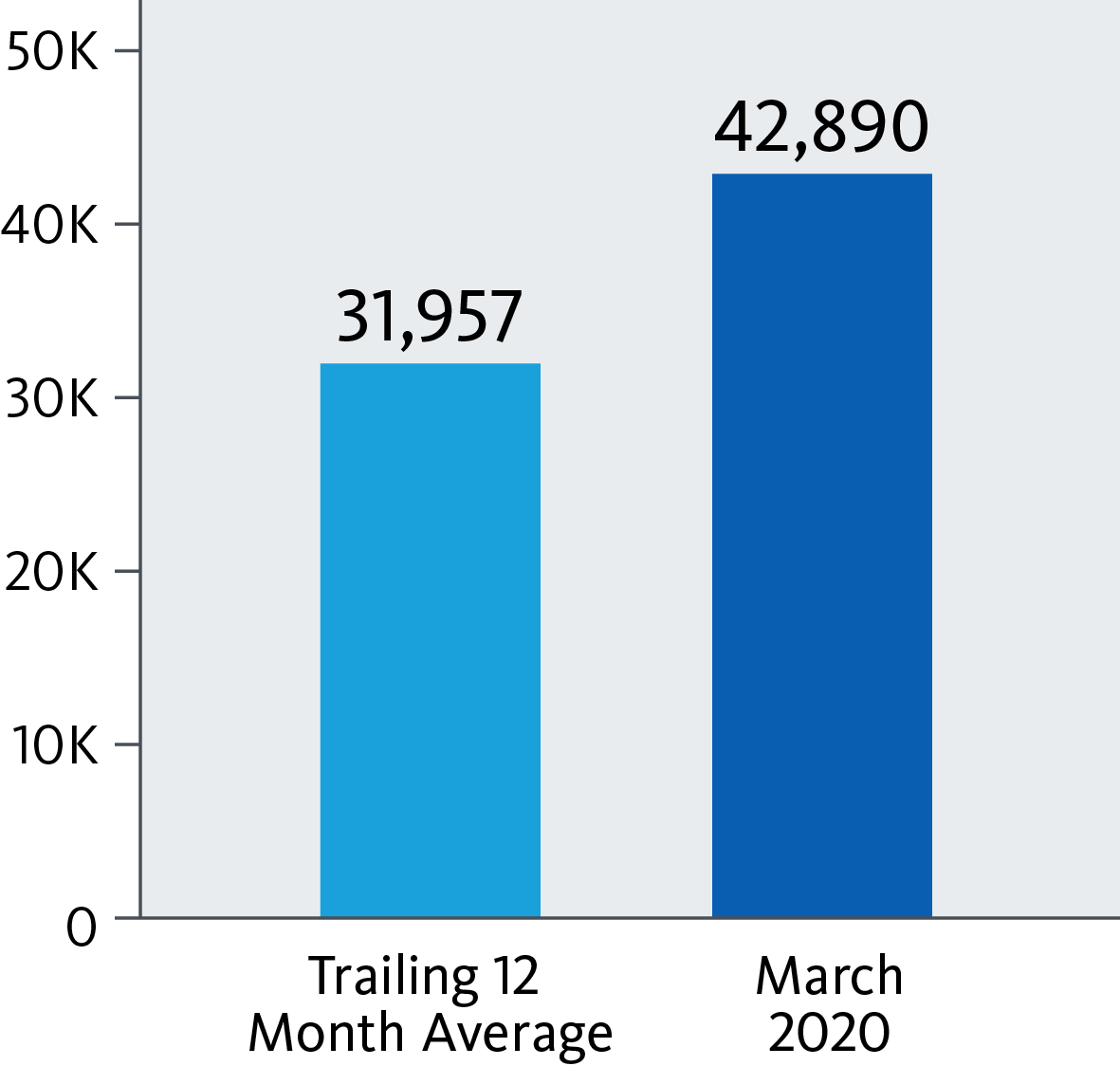

Diving in deeper, we noticed overall portfolio transparency across the Clearwater solution in March was at a volume in line with peak months like January. Our analysis found an increase of nearly 13,000 views of reports specific to monitoring portfolio risk in March compared to the same time last year, as investors looked into cashflows, issuer concentrations, security types, and trend analysis. There was a marked increase in the number of reports accessed for credit events and credit rating exposure during this time period, as investors sought to understand how spread widening would impact credits in their portfolio, including potential downgrades.

Also notable is the usage of the cashflow and duration reports. Cashflow analysis is generally one of the most frequently used reports, but both cashflows and duration-related reports saw increases of almost over one-third from February. As shown in the graph above, risk in general was at the forefront of our clients’ minds — unsurprisingly — but candidly, we haven’t seen such a one-time peak since 2008.

Diving Deeper: Connecting Events to Report Usage Increases

If we break this down even further, we can trace the accessing of these reports daily as the government and markets began to wrap their arms around the situation. In the week of March 16-20, a week when most of our clients and Clearwater itself were activating work from home in anticipation of a worsening pandemic, the volume of reports run to assess portfolio risk spiked on the 18th. This was the same day the Dow closed below 20,000, and the 10-year and 30-year treasuries hit all-time low yields as investors sought comfort and quality, peaking demand.

The 18th was outdone a few days later by Monday, March 23. As investors spent a weekend digesting almost nothing but bad news, our clients returned to their desks on Monday as the WHO officially put the world on notice that the pandemic was accelerating. The NYSE went all electronic, and while the Fed promised near unlimited support for asset purchases, the 10-year was trading below 1% before the open. The day would end with new lows in equity markets – reversing almost all bull-returns since 2016. Spread instruments in the bond market did not fare much better as investors continued to move toward cash and treasuries. Meanwhile, ratings agencies downgraded 3,675 individual CUSIPs across 737 issuers, while also putting a multitude of other credits on watch.

While expected, such volumes indicate just how widespread the de-risking – both in the monitoring and in the activity — has been. The report usage substantiates the justified investor reaction, as the news around COVID continued to worsen. We expect duration risk respective of cashflow redeployment and immunization against volatility to be a main focus, as well as the risk posed with security types (corporates and municipals) as ratings and spread volatility imperil future returns and push for a continued reassessment of risk appetite and allocation. It’s very likely, if not certain, COVID-19 becomes synonymous with “dot-com” and “subprime” when we ask our clients, “how do you think about risk?”

During these times of uncertainty and volatility, it’s vital for investors to have up-to-date data at their fingertips to analyze risk with complete transparency into their portfolios. As evidenced by the numbers we’ve shared here, our clients are relying heavily on Clearwater reports to provide the information they need.

To learn more about how we are helping companies like yours, contact our Solution Consultants Team.