Andrew Freter

Enterprise Solutions Leader

As an Asset Management Solutions Executive at Clearwater, Andrew supports the relationship coverage for current and prospective clients on the Enterprise Solutions Team. In this role, he works with a wide variety of investment management firms to modernize their infrastructure and optimize their portfolio management and target operational workflow. Andrew joined Clearwater in 2014 and has specialized within the investment management vertical in roles across both sales and client services. Andrew received his Bachelor of Science Degree from Utah Valley University.

Do asset managers care about accounting? We all know the front-office steers the ship in terms of generating alpha, diversifying assets to moderate risk, and creating a story that their current and potential investors can get behind – but why should asset managers care about debits and credits?

At Clearwater, a core value we provide thousands of institutions (insurers, corporations, governments, etc.) is our bedrock dual-entry investment accounting software. We are the trusted book of record for these firms who book their journal entries, produce their financial statements, and support their audit of the investment sub-ledger and financial disclosures. But why should an asset manager prioritize that level of detail, when so much is invested in data management and client reporting? In most cases, it’s because they aren’t asked to produce journal entries, and outside of fund managers, rarely need to view a trial balance or General Ledger. This creates a perception that book of record accounting is a low priority for many asset managers.

However, we’ve found this is quite the opposite. Most managers care about a portfolio accounting methodology that aligns to that of their clients. They care, their clients care, and we care too.

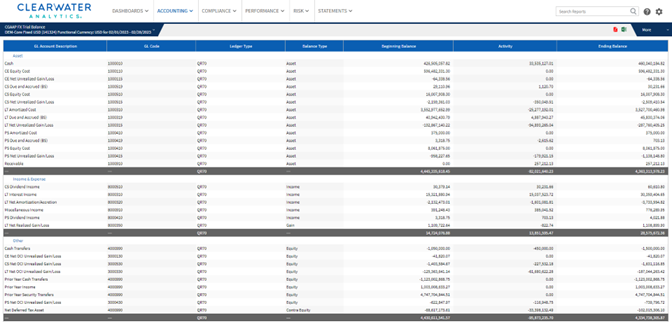

Trial Balance | Clearwater Analytics

Accounting software for asset managers serves several pivotal use cases that help keep firms on track. At the risk of sounding redundant, the front-office steers the ship, but the back-office accounting and operations teams keep the ship afloat and out of dangerous waters. Portfolio accounting software can help guide investment decisions with the end client in mind, that generate yield for the front office and create a value chain across cost centers.

Let’s consider a common real-world scenario: An asset manager, navigating the headwinds of fee compression, elects to expand strategies to incorporate higher yielding bonds to help boost performance. The strategy includes greater exposure to CMBS, testing the limits of their current reporting or accounting platform. The firm allocates assets to the new strategy, but has limited insight as to how that may impact the P&L of their clients. What can result is tax, gain/loss, performance, and regulatory challenges, that inhibit the strategies’ overall outcome.

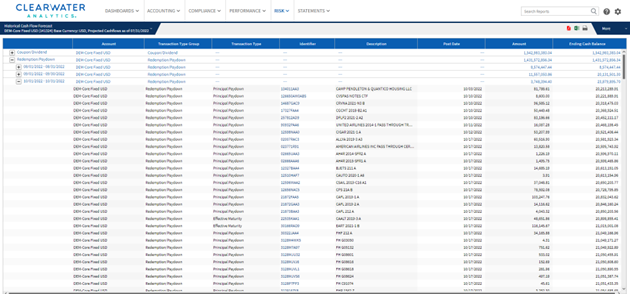

With Clearwater’s multi-asset accounting engine, CMBS positions are reflected with flexible amortization calculations, FAS 91 adjustments, and daily SMF updates, including updated factors and prepayment speeds for all cash flow projections and yield calculations. This allows the manager to see the complete picture – even while the client maintains their book of record responsibilities. They can outline exactly what income is attributed to amortization and accretion vs. income due to principal paydowns, interest income, and project future income. Also, they can more accurately state the gain/loss amounts prior to disposing of that asset.

If your client manages multiple accounting bases, Clearwater allows you to toggle between those bases to ensure any impact to those books is considered. In short, Clearwater shifts the manager to an offensive position with the end client, rather than a reactive, defensive stance after the trade has occurred – without needing to fully take on the responsibility of being book of record.

Cash Flow Forecast | Clearwater Analytics

Features & Benefits of Accounting Software for Asset Managers

Software Built for Asset Managers

Software built for asset managers is designed to help asset managers account for, report on, and better manage their clients’ portfolios. Asset managers can use the software to analyze the risk and return of different investments, identify potential investment decisions, report tailored packages to end clients, and reduce the risk of SEC or GIPS audits creating additional compliance issues for the firm. Asset management is built on relationships, and Clearwater’s tools empower a stronger relationship with your clients.

Additionally, asset managers can use the software as a tool to distribute to their end clients. Not only serving as a client portal, but also expanding to serve as book of record in situations where you are managing their entire portfolio. Strategic partnerships like this can help asset managers efficiently manage their portfolios and strengthen the relationships of current and prospective investors. Speaking of accounting, this efficiency grows top-line revenue and reduces the bottom-line impact on your PnL, from an ROI perspective.

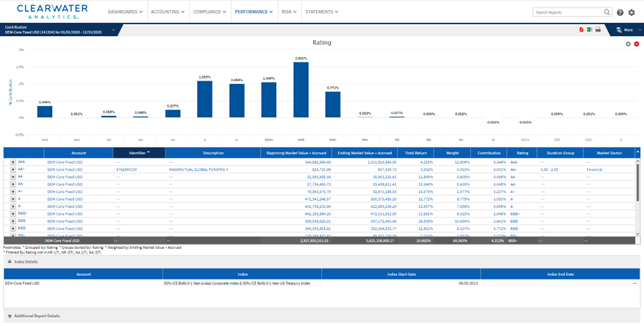

Streamline Data and Reporting

Investment accounting reporting software for asset managers can help by providing a comprehensive, automated platform for managing all investments. It can help asset managers quickly and accurately track daily valuations, generate detailed analytics, and analyze performance contributors. By automating the accounting process, asset managers can save time and money while improving accuracy and efficiency.

Performance Contribution | Clearwater Analytics

Aggregate Data from Multiple Locations

Your client’s assets are held in various safekeeping locations, and as your strategies diversify, aggregation tooling also must adapt as more direct investments, real assets, and mortgage loans require different data requirements. Enriching the portfolio becomes increasingly complex as security master files become less available. Our goal at Clearwater is to provide a centralized solution for all assets that supports all asset classes in their unique respective models.

Manage Clients’ Investment Data with Unmatched Accuracy

Accounting software can automate the tedious and time-consuming tasks of tracking investments, calculating returns, and generating reports. Clearwater places a large emphasis on daily reconciled and validated data that is accurate, timely, and complete. A complete dataset enables our accounting calculator to optimize the user’s experience. Without this scrutiny, the reporting lacks the depth needed to retain business.

Build Customizable & Intuitive Reports

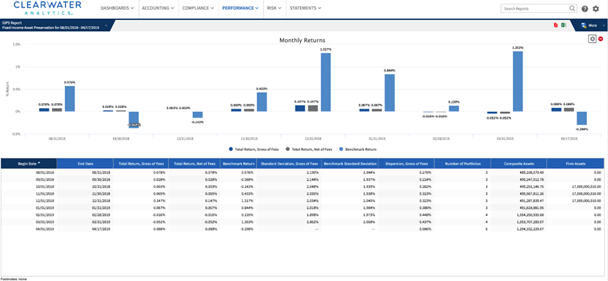

Beyond just accounting, the software is a great asset for creating intuitive reports. It can help to create detailed reports that include all relevant information, such as cash flows, income and expenses, contribution, and attribution, as well risk measurement to help create comfort in your clients’ decision to partner with you. Additionally, the software can be used to generate graphs and charts that provide a pixel perfect representation of the data for client meetings, quarterly packages, and marketing pitchbooks.

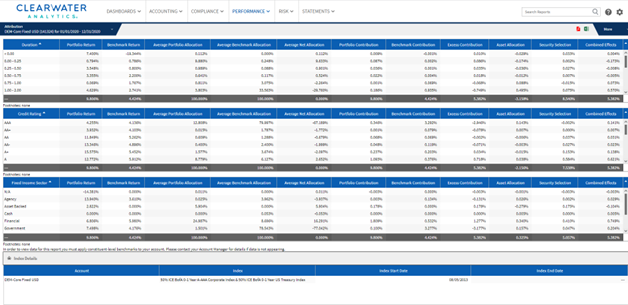

Performance Attribution | Clearwater Analytics

Asset Managers Rely on Accounting to Manage Middle and Back-Office Tasks

Accounting is the backbone of many downstream processes and system integrations including performance attribution, risk, client invoicing, and composite management. Accurate accounting figures drive these tasks with daily, audit-quality data used to tie out downstream data points.

GIPS Composite Audit Report | Clearwater Analytics

Self-Service Portal for Ad-Hoc Report Requests from Internal Users and External Clients

Accounting software helps streamline the process of creating and delivering ad-hoc reports to clients. Leveraging an intuitive self-service portal, your clients can easily request reports without needing to contact the manager directly. The manager can share custom-built reports with a few clicks and produce tailored packages and pitchbooks that better articulate their story, especially in times of market turmoil where asset preservation is most important. This also creates a quick and efficient way to view your broad book of clients from a single view. Cross reference across clients and analyze trends to quickly answer client questions and ensure consistent delivery of your products.

Replace Your Legacy Reporting Systems

New software can help replace legacy reporting systems by providing a more efficient, accurate, and secure way to manage financial data. This software can automate processes, streamline reporting, and provide real-time visibility into financial performance, but doing so in a secure, cloud-based SaaS platform reduces your internal IT footprint and allows you to be more nimble in your environment. No more hot fixes, version upgrades, server maintenance, and patchwork. Clearwater is updated daily, ensuring you are always on the latest version.

Clearwater Analytics

Clearwater Analytics is a powerful investment accounting and operations solution that is used today to report on over $6.4T in assets. It provides a comprehensive suite of tools to streamline the asset management trading lifecycle, including front-, middle-, and back-office tasks. Clearwater Analytics’ true SaaS platform creates an unparalleled user experience, the highest degree of data accuracy, and vastly appreciating product to meet your growing business requirements.

To learn more about accounting software for asset managers and the Clearwater Analytics solution, schedule a demo today.