John Sigrist

Solutions Consultant

John has been with Clearwater Analytics since 2018. He currently lends his expertise as a solution consultant for corporate treasuries and REITs. During his time with Clearwater, John has managed implementations, served as a subject matter expert for client servicing, and acted as a technical resource for clients and prospects. He has collaborated with clients across all of Clearwater’s markets, and he has helped many clients with their mortgage loan-heavy books.

John holds bachelor’s degrees in finance and operations management from the University of Idaho.

In a rising interest rate environment, institutional investors balance capturing yield with liquidity requirements for their business. Given current duration risk, many institutions and treasury teams are turning to Repurchase Agreements (Repos) to accommodate short-term financing and liquidity.

Here are three things to keep in mind about the Repo market and the important role of technology in this space.

1. Repos as Short-Term Financing Solutions

A Repo (or Reverse Repo, from the other side of the bi-lateral trade), is a short-term agreement to sell securities in order to buy them back at a slightly higher price. The time horizon typically ranges from one day to three months, depending on the need of the institution.

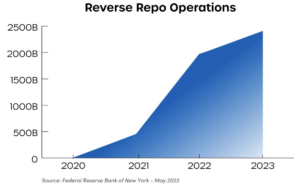

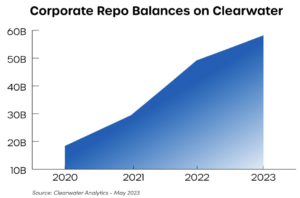

For some, these investments are primarily used for short-term cash to cover business or operating expenses. Others will leverage Repos for additional cash to reinvest or restructure existing portfolios, or to gain additional short-term yield on cash. Since mid-2021, the volume of Repos traded has risen dramatically. This is echoed on the Clearwater platform, where Repos have more than tripled in volume.

The sold securities act as de facto collateral for the counterparty, who owns the security through the predefined term until they contractually sell the securities back to the other party at the maturity of the agreement. This growth in repos has compounded the natural challenges associated with this asset class, namely aggregation, asset modeling and collateral tracking, and timely reporting.

2. The Challenge of Back-Office Reporting

Most Repo investors rely on a collateral agent (typically their custodian bank) to choose and post securities collateral for the Repos they enter. Collateral is held in a trust account through the life of the Repo agreement.

The timing and nature of Repos create unique reporting and accounting challenges for back-office teams. These challenges include modeling the Repo terms and conditions, tracking collateral, reconciling cash movements to contractual obligations, and calculating and reporting the haircut, among others.

Back-office reporting is needed to ensure accurate, timely data on Repos can be viewed and shared across the treasury/trading teams for investment planning and decisions, and ultimately into journal entries and financial disclosures.

3. Repo Investors Use Clearwater

Clearwater is the top solution on the market for institutional investor data aggregation, investment reconciliation, investment accounting, and reporting. As the Repo market continues to grow, investors are turning to technology to automate data management for these instruments. Many are already on the Clearwater platform. Since June 2021, the number of Repo assets on the platform has more than tripled, from $18 billion to $58 billion.

Each day, Clearwater integrates with order management systems, Repo and collateral platforms, custodians, and brokers to bring each part of the trade cycle together in a single place. That data is reconciled to ensure payments and accruals are accurate, then pushed to the web-based reporting interface for clients to view each morning.

Automation for timely, accurate investment data is a key element of investing in Repos. Speak with a Clearwater expert today about how Clearwater can help.