Yuriy Shterk

Global Head of Alternative Assets

Yuriy Shterk leads Clearwater’s global alternatives team, focusing on providing a best-in-class, front-to-back platform tailored for the unique challenges and opportunities presented by alternative assets. Yuriy brings a wealth of expertise from his 25-year career experience in the alternative assets sector. His career includes leadership positions where he led product and solution development for the private markets, derivatives, and the broader alternative assets market, building a deep understanding of client needs in these areas. Prior to joining Clearwater, Yuriy served as Chief Product Officer at Allvue Systems, responsible for growing alternative asset revenue streams. Prior to Allvue Systems, Yuriy served as Head of Product Management for Derivatives at Fidessa, along with multiple leadership roles at CQG.

As interest in private and alternative investments surges, liquidity and cash flow needs are spurring some novel investment solutions, which can require new or enhanced management tools. Because while alternatives may show very attractive returns, realizing those gains can sometime present significant obstacles. Insufficient insight into asset liquidity can trigger forced selling, unfavorable pricing, and diminished returns.

For example, increasingly popular evergreen funds provide may periodic withdrawals but represent a more complex set of underlying assets, investment horizons, and maturity assessments than a traditional VC or PE closed fund. Similarly, Rated Note Feeder Funds (RNFs) may look like a structured loan instrument, but with more complex terms, asset valuations, and risk assessments.

As a result, there is still a substantial premium in workload and timeliness on alternatives, prompting investment teams to review and revise how they model and manage these parts of their portfolios. Three capabilities stand out as essential for these new or enhanced tools:

- Getting the data

- Modeling cash flows

- Assessing risks

1. Getting the data

There is so much valuable data available today, with increasing complexity, that capturing, organizing, and validating it consumes far too much time for most investment teams. Automation is essential here, reducing the time spent gathering and extracting data from PDFs, emails, reports, portals, and a myriad of other sources into a centralized data cloud. Thankfully, most modern risk and portfolio management platforms include a wide array of adapters, connectors, and other mechanisms for ingesting multi-asset data.

However, as funds become more sophisticated, managing the associated data gets increasingly complex. This shift means that investors need to adopt smarter strategies for data integration and analysis. Rated Note Feeder Funds (RNFs) are a great example of this growing complexity. Their detailed capital structures bring a host of new data points that institutional investors need to keep an eye on to effectively manage risks and achieve optimal returns.

And getting the data is only part of the job — cleansing and validating it is even more important. From simpler load and transform functions to advanced logic analyzers, intelligent data ingestion capabilities work to rationalize the ingested data to create a more holistic set of investment information. And generative AI (GenAI) is quickly adding its abilities to these tasks, creating an intelligent layer that interconnects systems with semantic understanding for improved reconciliation and exception handling. Together, these capabilities are enabling teams to find their desired balance between automation and human judgment, augmenting human workflows and helping to further shift resources from data gathering to data-driven analysis and decision making.

2. Modeling cash flows

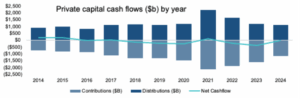

Cash flows of private assets come in an infinite range of patterns, from the expected monthly distributions of structured loans to one-time capital distributions upon maturity or closure, the negative cash flow of capital calls, and everything in between. Modeling these complex or bespoke instruments requires a platform that is not only transparent about its out-of-the-box functions but is extensible to handle a full range of modifications, from minor adjustments to completely custom or proprietary models.

Equipped with these capabilities, investment teams can quickly evaluate potential investments, easily and consistently update valuations, monitor expected versus actual cash flows, and be alerted to any asset-liability mismatches.

GenAI is also adding value to these assessments, providing real-time insight into potential mismatches and even recommending portfolio adjustments to optimize returns. One example that underscores the power of centralized data and extensible cash-flow models is real-time views of consolidated balance sheets that enable executives to drill down into individual assets or transactions. The investment team can engage in real-time decision making to manage market events, maximize liquidity, minimize cash outflows, and otherwise address a duration mismatch of assets to liabilities.

3. Assessing risks

Finally, effective risk assessment of private assets is a product of the centralized data cloud and the appropriate models, run against the desired scenarios. The ideal result is a consistent and consolidated view in a single pane of glass for all public and private assets in the portfolio that rolls up risks and exposures derived from each individual instrument, not proxies or placeholders. Like a good pane of glass, this dashboard should be transparent to the underlying assets, with selection and drill down capabilities from firm level all the way down to each individual asset and its components.

Monitoring and reporting tools should deliver risk and performance insights through a range of mechanisms, including real-time and interactive dashboards, reports, and alerts. Visualization tools make the vast amount of data easier for humans to digest. Whether that is reviewing standard risk metrics or highlighting breaches, exposures, or other internal or regulatory compliance issues.

Closing remarks

Modern, cloud-based investment management platforms are becoming a necessity for getting the optimal performance out of a multi-asset portfolio with the desired level of private market risk. These solutions enable teams to assess the impact of market shocks, macro events, and hypothetical trades in support of informed decision-making and scalable operations across the investment lifecycle.

Leveraging 10-years of data, powered by Pitchbook, our latest report “The Rise of Alternatives: Access, Liquidity, and Opportunity” provides a detailed analysis of why private markets are growing, where the money is coming from, and how investment managers are incorporating these less-liquid assets into portfolios.

You can download the full report from here.