Sabrina Wilson, CPA, FLMI

Global Regulatory Policy Expert

Sabrina serves as a subject matter expert for regulatory filings at Clearwater. In this role, she works with internal teams for the ongoing enhancement of NAIC reports. Sabrina has over 20 years’ of statutory accounting and reporting experience and uses her background to communicate industry best practices and comment on regulatory guidance and procedures. She also handles complex statutory accounting and analytics questions posed by our user community.

Sabrina is a certified public accountant, has earned the designation of Fellow, Life Management Institute (FLMI), and has a master’s degree in accounting and taxation from Boise State University.

Several working groups from the National Association of Investment Commissioners (NAIC) held meetings in April. One outcome to note is that the Risk-Based Capital Investment Risk and Evaluation Working Group (RBCIREWG) will have to decide the risk-based capital (RBC) factor for residual tranches of all asset-backed securities by June 30, 2023, to ensure the RBC factor takes effect for life insurers at the end of the year. Property and casualty and health insurers will follow the same factor next year. The RBCIREWG will have their next meeting on May 17, 2023.

The following updates pertain to investment accounting.

Risk-Based Capital Investment Risk and Evaluation Working Group

The RBCIREWG of the NAIC held a virtual meeting on April 20, 2023.

Adopted items with an effective date of December 31, 2023

2023-03-IRE Adding Residual Tranche to LR008 Other Long-term Assets

This adopted item adds an additional line (line 51) for residual tranche to LR008, removes the residual tranches from Line 49.2, and renumbers the subsequent rows.

Interested parties asked the working group to update the RBC formulas of residual tranches for health and property and casualty. The working group’s Chair said residual tranches are more pronounced for life insurers. Their initial exposure was for life insurers this year, because the E-Committee directed them to focus on life insurers first, then move on to other insurer types. They will follow up with health and property and casualty after this year.

2023-04-IRE Adding Residual Tranche to LR038-LR039 Sensitivity Tests

This update was proposed by the American Council of Life Insurers, who believe it could be an additional tool to help regulators review companies and their investments in residual tranches. It adds residual tranches to the sensitivity testing exhibits (LR038-LR039) and renumbers LR040.

As this proposal was exposed after January 31, 2023, the working group would have preferred an affirmative vote with a two-thirds supermajority. However, it was adopted with less than a supermajority of votes (passing 10 to 6).

These two items are also adopted by the Capital Adequacy Task Force on April 28, 2023, with the understanding that the task force may revisit agenda item 2023-04-IRE once the RBC factors are determined by the end of June 2023.

Items Exposed for 21 Days

Proposed RBC Factor for Residual Tranche of All Asset-Backed Securities

This proposed change would increase the RBC factor for residual tranches from 30% to 45% with an effective date of December 31, 2023.

Most regulators agreed with the proposed increase to 45%, but some regulators proposed an RBC factor range between 30% and 45%, or keeping the RBC factor at 30%. Some regulators said the RBC helps them identify the “trouble” companies and allows them to address issues quickly.

Some regulators expressed concern that the increased factor will encourage life insurers to not admit the residual tranches instead of keeping them on the RBC. For example, if a life insurer invests $100 in the residual tranche, it requires them to maintain $135 ($100 x 45% RBC Charge x 3) of capital for this residual tranche investment if they maintain 300% of the Authorized Control Level Risk-Based Capital and the C1 factor is 45%. The required capital for maintaining a 100% ACL RBC, before any covariance, is $45 ($100*45%). The required capital to maintain a 300% ACL RBC ratio is greater than the original investment itself ($100) and it seems excessive.

The traditional insurer group said there are many ongoing discussions about how much the RBC charge should be. They are supportive of a 45% RBC charge, which is consistent with the existing high-beta equity charge. They also provided information that they hope will help the regulators understand the background of the 30% RBC charge of unaffiliated equities. The 30% factor was developed in the 1990s based on S&P 500 public equity losses between 1960 and 1991. Residual tranches provide first-loss protection for bond tranches and, theoretically, residual tranches can lose close to their full value in stress scenarios. There is no justification for treating the residual tranches as equities.

The private equity-owned insurance representative said the regulators should regulate the insurers and discipline those suspicious insurers. The representative also said it is inappropriate to adopt changes that affect all insurers.

Proposed Additional Sensitivity Factor for Residual Tranche of All Asset-Backed Securities

This proposes setting the additional sensitivity factor to 0.10 for residual tranches. The interested parties representing PE-owned insurers said increasing the factor may shift or increase risk and it is counter-intuitive. The working group’s Chair said the RBC is supposed to identify weakly capitalized insurance companies, and sometimes they make decisions that sacrifice simplicity.

Life-Risk Based Capital Working Group

The Life-Risk Based Capital Working Group of the NAIC held a virtual meeting on April 14, 2023. The following updates pertain to investment accounting.

Adopted Item effective December 31, 2023

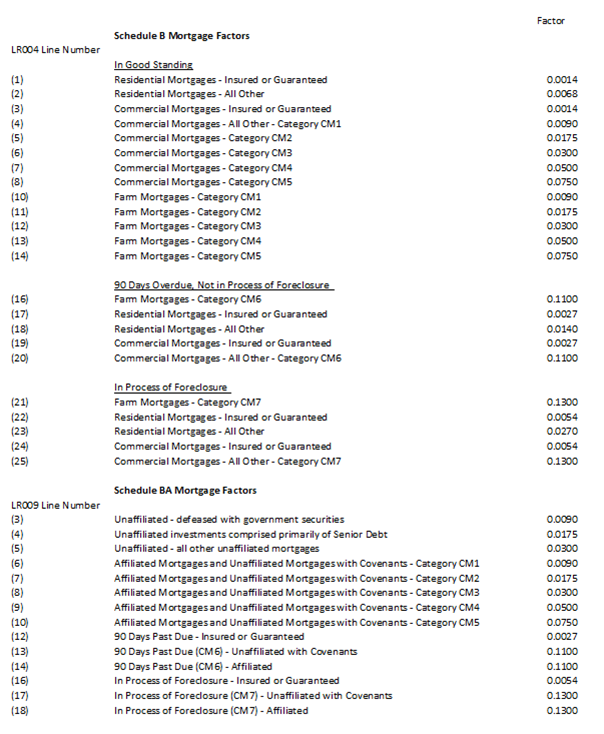

Revisions to CM6 and CM7 Mortgage RBC Factors and Formula on LR004 Schedule B Mortgages and LR009 Schedule BA Mortgages

This item eliminates the calculation worksheets for non-performing loans; going forward they will use the same RBC calculation formula as performing mortgages. The proposal also reduces RBC factors from 18% to 11% for CM6 mortgages and from 23% to 13% for CM7 mortgages with effective date of December 31, 2023. The goal is to align the RBC factors for CM6 and CM7 non-performing commercial and farm mortgages with the RBC factors for Schedule A and Schedule BA Real Estate Investments.

Valuation of Securities Task Force

The VOSTF adopted the following change via eVote on April 21, 2023.

Proposed Update the Notice of Credit Deterioration for the List of Qualified U.S. Financial Institutions (QUSFI)

It adds the changes to the SVO P&P Manual, Part Two paragraph 135 to allow the SVO to remove a financial institution from the list of QUSFI once the institution is closed by and/or placed in receivership or conservatorship, or notice is given of such action by their primary regulator(s). The reasons for this change are the recent bank incidents, in which both Silicon Valley Bank and Signature Bank were not downgraded below the minimum permitted ratings of BBB-/Baa3 prior to receivership, and the most recent financial statements did not reflect sufficient financial weaknesses to warrant adding those financial institutions to the QUSFI Watch List.

The QUSFI list indicates the financial institutions eligible to issue letters of credit pursuant to NAIC Credit for Reinsurance Model Law#785. The letter of credit can be used to reduce the insurer’s liability.

The VOST will have their next meeting on May 15, 2023.